Is NVIDIA Corporation Stock a Good Investment for 2024?

Introduction to NVIDIA Corporation Stock

NVIDIA, short for NVIDIA Corporation, is more than just a tech company—it’s a behemoth in the world of graphics processing. Founded back in 1993 by Jensen Huang and his team, NVIDIA started as a tiny startup but has since grown into a trillion-dollar titan. Their claim to fame? The Graphics Processing Unit (GPU), which powers everything from your gaming rig to the AI that’s changing the world.

As we head into 2024, NVIDIA’s stock is making waves—again. With a focus on high-growth areas like artificial intelligence and autonomous vehicles, NVIDIA has become Wall Street’s darling. But before you jump in, let’s not forget the risks. Market volatility, competition, and global economic shifts are all factors that could shake things up. In this post, we’ll break down everything you need to know about investing in NVIDIA in 2024.

Financial Performance of NVIDIA Corporation Stock

NVIDIA’s financials aren’t just good—they’re stellar. The company has been on a tear, with revenue hitting around $46 billion in 2023 alone. This growth is no accident; it’s driven by the insatiable demand for GPUs across gaming, AI, and data centers.

Profitability? NVIDIA’s margins are the envy of many. Consistently above 60%, their gross margins show just how efficient and dominant they’ve become in this space. And let’s not forget about earnings per share (EPS), which has been steadily climbing year after year, painting a picture of a company in great financial health.

Looking at the numbers more closely, NVIDIA’s compound annual growth rate (CAGR) from 2018 to 2023 was a whopping 45%. That’s insanely high for a company of its size. This rapid growth is thanks to AI adoption, data center expansion, and the gaming boom.

Future Growth Drivers for NVIDIA Corporation Stock

NVIDIA’s future looks bright—thanks in large part to AI. The company is leading the charge with its CUDA platform and A100/Hopper GPUs, which are essential for handling complex computations. As more industries dive into AI, NVIDIA stands to gain even more market share.

Autonomous vehicles are another big bet. NVIDIA’s DRIVE Orin platform is a key player in self-driving tech, and as this technology matures, NVIDIA could be sitting on a goldmine. Plus, their data center business continues to thrive. With the world increasingly relying on cloud computing and big data, NVIDIA’s GPUs remain indispensable.

Risks Associated with Investing in NVIDIA Corporation Stock

Of course, no investment is without its risks. NVIDIA faces tough competition from companies like AMD, Intel, and Qualcomm. These competitors are always looking to nibble away at NVIDIA’s market share, especially in areas like consumer GPUs and data centers.

Economic downturns could also be a headwind. The tech sector often takes a hit during recessions, and NVIDIA’s reliance on high-end GPUs makes it particularly vulnerable. If consumers and businesses start cutting back, NVIDIA could feel the pain.

Supply chain issues are another wildcard. NVIDIA relies heavily on third-party manufacturers for its chips, which means any disruption—be it geopolitical tensions or natural disasters—could throw a wrench in their operations.

Competitor Analysis for NVIDIA Corporation Stock

NVIDIA’s competitors are no slouches. AMD is the closest rival, especially in consumer GPUs. Over the past few years, AMD has made serious strides and now holds a significant chunk of the market. While NVIDIA still reigns supreme overall, AMD’s advancements can’t be ignored.

Intel is another major player, particularly in data centers and AI. Their Xeon processors are widely used in servers, and their foray into GPUs with the Arc series adds even more competition to the mix. Qualcomm isn’t resting on its laurels either, especially in the autonomous vehicle space. But NVIDIA’s expertise in AI gives it a clear edge here.

Market share-wise, NVIDIA is still king of many segments, particularly high-end gaming and professional GPUs. But AMD and Intel are hot on their heels, which means NVIDIA can’t afford to rest on its laurels.

Valuation Metrics for NVIDIA Corporation Stock

When it comes to valuation, NVIDIA’s numbers tell a story of investor optimism. The price-to-earnings (P/E) ratio is high compared to other large-cap tech stocks, reflecting the market’s belief in NVIDIA’s future growth. But this also means that any missteps or missed expectations could lead to big swings in the stock price.

The price-to-book (P/B) ratio is another metric worth watching. NVIDIA’s P/B has been higher than industry averages, showing that investors are willing to pay a premium for its intangible assets and growth potential. This makes sense given their focus on R&D and innovation.

Finally, the price-to-earnings-to-growth (PEG) ratio gives a more complete picture by factoring in growth rates. While NVIDIA’s PEG is high, it aligns with expectations of strong future earnings growth, making it an attractive option for investors looking for high-growth opportunities.

How to Invest in NVIDIA Corporation Stock

Investing in NVIDIA isn’t a one-size-fits-all proposition. If you’re in it for the long haul and believe in NVIDIA’s future, then buying and holding might be your best bet. This strategy works well if you’re comfortable with market volatility and have a high tolerance for risk.

For those looking to trade more actively, strategies like swing trading or day trading could be options. But these come with higher risks and require a deeper understanding of the market. Another approach is to invest in ETFs that include NVIDIA among their holdings. This diversification can help spread out your risk while still benefiting from NVIDIA’s growth.

Dollar-cost averaging (DCA) is another strategy worth considering, especially if you’re worried about market volatility. By investing fixed amounts regularly over time, DCA helps smooth out the impact of price swings and could lead to a lower average cost per share in the long run.

Conclusion on Investing in NVIDIA Corporation Stock for 2024

NVIDIA Corporation stock is undeniably an exciting investment opportunity heading into 2024. With its strong financials, leadership in AI and autonomous vehicles, and innovative product lineup, NVIDIA has a lot to offer. But as with any investment, there are risks to consider—competition, economic shifts, supply chain issues, and more.

Investors should take the time to evaluate NVIDIA’s valuation metrics and align their strategies with their financial goals and risk tolerance. Whether you’re looking to hold for the long term, trade actively, or diversify through ETFs, there are options that can fit your investment style.

Ultimately, whether NVIDIA is right for you depends on where you see yourself in this journey. Do your homework, stay informed, and consider consulting with financial professionals before making any moves. After all, investing is a marathon, not a sprint—and NVIDIA could very well be a key player in your portfolio’s future.

From Analysts to Markets: Tesla Stock Predictions Today Everyone’s Talking About

Introduction to Tesla Stock Predictions Today

Let’s kick off by talking about Tesla as we step into 2023. This electric vehicle pioneer isn’t just another car company; it’s a cultural icon with ripples in global markets. Investors are buzzing—should they buy, hold, or sell? Let me break this down for you.

Tesla’s influence is massive. It’s reshaping industries, pushing tech boundaries, and sparking conversations on sustainability. With such an impact, it’s no wonder Tesla stock predictions today are a hot topic among analysts, investors, and even casual observers. Here’s why they’re focusing on Tesla in 2023.

The Impact of Tesla on Global Markets

Tesla isn’t just a stock; it’s a symbol of the shift toward greener tech. Its success trickles down to automotive, energy storage, and renewable sectors. As countries cut carbon emissions, Tesla leads this charge, making it a key player in market dynamics.

Plus, Tesla’s stock performance mirrors investor sentiment towards EVs. When Tesla does well, it lifts others in the sector. But challenges like supply chain issues or regulations can send shockwaves. Let’s explore why investors are drawn to Tesla this year.

Why Investors Are Focusing on Tesla in 2023

Investors love Tesla for its scale and vision. Elon Musk’s ambitious roadmap includes AI, space exploration, and sustainable energy. This breadth attracts those seeking long-term growth.

Tesla consistently delivers despite obstacles. Its ability to innovate and adapt has built a loyal customer and investor base. So, whether you’re in for the long haul or looking for quick gains, Tesla offers potential rewards and risks.

Expert Analysts on Tesla Stock Predictions Today

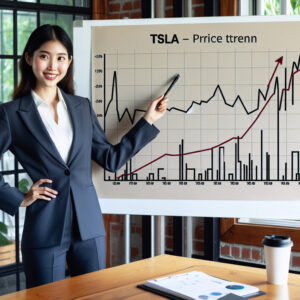

To get a clearer picture, let’s hear from experts. Financial analysts are crunching numbers, offering insights into Tesla stock predictions today. Opinions vary, but some common threads emerge.

Top Financial Institutions and Their Projections for Tesla

Firms like Morgan Stanley, Goldman Sachs, and Bank of America have weighed in. While there’s no consensus on exact price targets, most agree Tesla will benefit from the EV shift.

Morgan Stanley highlights Tesla’s battery tech leadership, while Goldman Sachs cautions about supply chain issues and competition. So, it’s a mix of optimism and caution.

Tech Analysts’ Take on Tesla’s Future

Tech analysts focus on innovation. They praise Tesla for staying ahead in autonomous driving and energy storage—key differentiators keeping Tesla competitive.

Contrarian Views and Risks to Consider

Not all are bullish. Some argue Tesla’s valuation may outpace fundamentals, pointing to high debt and competition as risks.

These cautionary notes remind us Tesla isn’t without challenges. Investors should weigh both strengths and vulnerabilities.

Market Trends Shaping Tesla Stock Predictions Today

Broad market trends also influence Tesla’s prospects. Let’s look at key factors shaping its future.

The Role of EV Adoption in Driving Tesla’s Growth

EV adoption is surging globally. Governments enforce stricter emissions, and consumers prioritize sustainability. This shift benefits Tesla as a trusted EV leader.

Supply Chain Challenges and Their Impact on Tesla’s Valuation

Despite strong demand, supply chain issues loom large. The global semiconductor shortage affects production, while raw material costs remain volatile, impacting profit margins.

Global Economic Factors Influencing Tesla Stock Prices

Macroeconomic factors like inflation and interest rates also play a role. Rising rates could make holding high-growth stocks like Tesla more expensive, affecting prices.

Tesla Financial Reports and Their Implications for Investors

Let’s dive into Tesla’s financial reports and what they mean for investors. The company shows strong revenue growth but faces challenges.

Key Metrics from Tesla’s Latest Earnings Report

Tesla reported record revenues and vehicle deliveries, with progress in reducing production costs and expanding manufacturing.

Revenue Growth and Margins: What They Mean for the Future

While revenue growth is impressive, profit margins are crucial. Investors watch Tesla’s ability to maintain or expand margins amid rising costs.

Investor Sentiment and Market Reactions to Tesla’s Performance

Market reactions are mixed, reflecting uncertainty. Some view progress as a growth sign; others remain cautious about near-term risks.

Risks and Challenges in Tesla Stock Predictions Today

Any Tesla discussion must address risks. Let’s explore key factors impacting its trajectory.

Regulatory Hurdles and Their Potential Impact on Tesla

Regulation is a double-edged sword. Supportive policies drive growth, while restrictive ones hinder expansion. Proposed EV tax credit changes in the U.S. are a concern.

Competition from Traditional Automakers and EV Startups

Rising competition from Ford, GM, Toyota, Rivian, and Lucid could pressure Tesla’s market share and pricing power.

Supply Chain Disruptions and Battery Tech Advancements

Supply chain disruptions persist. Competitors’ battery tech advancements could erode Tesla’s edge unless it innovates further.

How to Capitalize on Tesla Stock Predictions Today

If considering investing in Tesla, here are strategies to maximize returns and minimize risk.

Strategies for Short-Term and Long-Term Investors

Short-term investors might trade around earnings reports or news. Long-term investors may prefer a buy-and-hold approach, betting on Tesla’s leadership.

Diversification Tips for Balancing Risk in Your Portfolio

Regardless of your horizon, diversification is key. Pair Tesla with other EV companies or renewable energy firms to spread risk and enhance resilience.

Tools and Resources for Staying Updated on Tesla’s Performance

Stay informed by following financial news outlets, subscribing to industry newsletters, or using stock tracking apps.

Conclusion: What the Future Holds for Tesla Stock Predictions Today

Tesla stock predictions today are shaped by analyst insights, market trends, financial performance, and risks. While no crystal ball exists, understanding these dynamics aids informed decisions.

Recap of Key Insights from Analysts and Market Trends

Experts agree Tesla is well-positioned for the EV revolution but face challenges like supply chains and competition.

Final Thoughts on Investing in Tesla Amidst Uncertainty

Investing requires a balanced approach, considering potential rewards and risks. While Tesla has shown resilience, avoid hype-driven decisions.

Why Tesla Remains a Focus in the Global Economy

Tesla’s significance extends beyond its stock price, representing a broader shift toward sustainability and innovation reshaping industries and economies. For investors, understanding this context is key to navigating opportunities and challenges ahead.

Here’s the rewritten article with a more natural and conversational tone while maintaining SEO optimization:

—

Introduction to Tesla Stock Predictions Today

As we kick off 2023, one name that’s popping up in headlines and investor chats is Tesla. More than just an EV maker, Tesla has become a cultural icon with massive implications for global markets. Investors are itching to know where Tesla stock predictions today might lead—and whether now’s the time to buy, hold, or bail.

Tesla’s influence isn’t limited to its assembly lines. It’s shaking up industries, pushing tech boundaries, and sparking conversations about sustainability and innovation. With such a wide-reaching impact, it’s no surprise that Tesla stock predictions today are all the rage among analysts, investors, and even casual market watchers.

The Impact of Tesla on Global Markets

Tesla isn’t just another stock; it’s a symbol of the shift toward greener tech and sustainable living. Its success ripples across sectors like automotive manufacturing, energy storage, and renewable resources. As more countries commit to cutting carbon emissions, Tesla sits at the epicenter of this movement, making it a major player in global market dynamics.

Plus, Tesla’s stock performance often acts as a gauge for investor sentiment toward EVs and clean energy. When Tesla does well, it can lift other companies in the sector, creating a positive loop that drives growth. But when challenges arise—like supply chain hiccups or regulatory roadblocks—it can send shockwaves through related industries.

Why Investors Are Focusing on Tesla in 2023

Investors are drawn to Tesla for a few key reasons. First, there’s the sheer scale of its operations and vision. Elon Musk’s ambitious roadmap includes not just electric cars but also advancements in AI, space exploration, and sustainable energy solutions. This broad vision attracts those looking for long-term growth potential.

Additionally, Tesla has a track record of delivering on promises, even when the odds are stacked against it. Its ability to innovate and adapt has fostered a loyal fanbase of customers and investors who believe in its future. Time and again, this mix of vision and execution makes Tesla an attractive bet for those looking to ride the EV wave.

Expert Analysts Weigh In on Tesla Stock Predictions Today

To get a clearer picture of where Tesla is heading, let’s hear from the experts. Financial analysts and institutions have been crunching numbers and offering their takes on Tesla stock predictions today. While opinions vary, some common themes emerge.

Top Financial Institutions and Their Projections for Tesla

Major financial players like Morgan Stanley, Goldman Sachs, and Bank of America have all chimed in on Tesla’s prospects. Though there’s no consensus on exact price targets, most agree that Tesla is well-positioned to benefit from the ongoing EV revolution.

Morgan Stanley, for example, has highlighted Tesla’s leadership in battery tech and its ability to scale production as key growth drivers. On the flip side, Goldman Sachs has sounded caution about short-term risks like supply chain disruptions and competition from traditional automakers.

What Tech Analysts Are Saying About Tesla’s Future

Tech analysts bring a different angle, focusing on innovation and market disruption. Many have praised Tesla for its ability to stay ahead of the curve in tech development. For instance, advancements in autonomous driving systems and energy storage solutions are seen as key differentiators that will keep Tesla competitive.

Contrarian Views and Risks to Consider

Not all analysts are bullish on Tesla stock predictions today. Some contrarian voices argue that the company’s valuation may be outpacing its fundamentals, pointing to factors like high debt levels and intense competition as potential risks.

These cautionary notes remind us that while Tesla is undeniably a leader in the EV space, it’s not immune to challenges. Investors should approach Tesla stock with both eyes open, weighing its strengths against its vulnerabilities.

Market Trends Shaping Tesla Stock Predictions Today

The broader market trends also play a big role in shaping Tesla stock predictions today. Let’s explore some of the key factors at work.

The Role of EV Adoption in Driving Tesla’s Growth

One of the most promising trends is the accelerating adoption of electric vehicles worldwide. Governments are cracking down on emissions, while consumers increasingly prioritize sustainability when making buying decisions. This shift directly benefits Tesla, as it remains one of the most recognized and trusted names in the EV market.

Supply Chain Challenges and Their Impact on Tesla’s Valuation

Despite strong demand, supply chain issues continue to loom over Tesla. The global semiconductor shortage has been a recurring pain point, affecting production timelines and, in turn, revenue growth. Plus, the cost of raw materials like lithium and nickel remains volatile, which could impact profit margins in the coming quarters.

Global Economic Factors Influencing Tesla Stock Prices

Macroeconomic factors such as inflation, interest rates, and geopolitical tensions also influence Tesla stock predictions today. For example, rising interest rates can make it more expensive for investors to hold onto high-growth stocks like Tesla, potentially leading to downward pressure on prices.

Tesla Financial Reports and Their Implications for Investors

Let’s dig into Tesla’s financial reports and what they mean for investors. The company has consistently delivered strong revenue growth, but there are still areas where improvement is needed.

Key Metrics from Tesla’s Latest Earnings Report

In its most recent earnings report, Tesla reported record revenues and a significant increase in vehicle deliveries. The company also highlighted progress in reducing production costs and expanding its global manufacturing footprint.

Revenue Growth and Margins: What They Mean for the Future

While revenue growth is undeniably impressive, investors will be closely watching profit margins as a key indicator of financial health. Tesla’s ability to maintain or expand its margins in the face of rising costs will be crucial for sustaining long-term value.

Investor Sentiment and Market Reactions to Tesla’s Performance

Market reactions to Tesla’s financial reports have been mixed, reflecting the broader uncertainty surrounding its stock. Some investors view the company’s progress as a sign of continued growth, while others remain cautious about near-term risks.

Risks and Challenges in Tesla Stock Predictions Today

No discussion of Tesla stock predictions today would be complete without addressing the risks and challenges that lie ahead. Let’s explore some of the key factors that could impact the company’s trajectory.

Regulatory Hurdles and Their Potential Impact on Tesla

Regulation is a double-edged sword for Tesla. While supportive policies can drive growth, overly restrictive regulations could hinder expansion efforts. For example, proposed changes to tax credits for EVs in the U.S. have been a topic of concern among investors.

Competition from Traditional Automakers and EV Startups

The rise of new competitors is another significant risk factor. Established automakers like Ford, GM, and Toyota are ramping up their EV offerings, while startups like Rivian and Lucid are also making waves in the market. This increased competition could put pressure on Tesla’s market share and pricing power.

Supply Chain Disruptions and Battery Technology Advancements

As mentioned earlier, supply chain disruptions remain a persistent challenge for Tesla. Additionally, advancements in battery technology by competitors could erode some of the company’s competitive advantages unless it continues to innovate at a rapid pace.

How to Capitalize on Tesla Stock Predictions Today

If you’re considering investing in Tesla, there are several strategies you can employ to maximize your returns while minimizing risk. Let’s explore some options.

Strategies for Short-Term and Long-T

Tesla Stock Share Market Trends: What Investors Should Watch

Tesla Stock Share Market Trends: What Investors Should Watch

Let’s face it—Tesla isn’t just another car company. It’s the talk of the town for investors looking to ride the wave of electric vehicles (EVs) and sustainable energy. This isn’t just about stock performance; it’s a reflection of where the world is heading. In this guide, we’ll break down what’s driving Tesla’s stock trends, what’s happening right now, and how you can stay ahead in this fast-paced game.

Understanding Tesla Stock Share Performance

Historical Overview of Tesla Stock Growth

Tesla’s journey from a small automaker to a global tech giant is nothing short of legendary. Since going public in 2010, the company has seen its stock soar, thanks to groundbreaking innovations and skyrocketing consumer demand for EVs. From the Model S to the Cybertruck, each milestone has been more than just a product launch—it’s been a statement about the future.

Key Milestones in Tesla Stock Share History

Tesla hasn’t just made history; it’s rewritten the rules of the game. Becoming the world’s most valuable automaker, unveiling full self-driving capabilities—these aren’t just achievements; they’re proof that Tesla is here to stay. Each milestone isn’t just a win for the company—it’s a vote of confidence for investors everywhere.

Market Reactions to Major Tesla Announcements

When Tesla speaks, the market listens. Whether it’s a new product launch or an expansion into uncharted territories, every announcement sends ripples through the stock world. Investors are always on edge, wondering how each move will shape Tesla’s future. It’s not just about numbers; it’s about vision.

Fundamental Factors Driving Tesla Stock Share Trends

Electric Vehicle Adoption and Its Impact on Tesla Stock

The shift to electric vehicles isn’t just a trend—it’s a revolution. As more countries crack down on emissions, the demand for EVs is skyrocketing, and Tesla is at the forefront. This isn’t just good news for the environment; it’s great news for investors looking to cash in on this growing market.

Supply Chain Challenges and Their Effect on Tesla Shares

No matter how innovative you are, supply chain issues can throw a wrench in even the best-laid plans. From semiconductor shortages to production delays, these hurdles can have a direct impact on Tesla’s stock performance. The question is, can Tesla navigate these challenges and come out stronger on the other side?

Competitor Activity and Its Influence on Tesla Stock Performance

Tesla may be the king of EVs, but the competition is heating up fast. Traditional automakers like Ford and GM, along with tech giants like Apple, are throwing their hats into the ring. While this adds some spice to the market, Tesla’s brand loyalty and cutting-edge technology keep it ahead of the game.

Government Policies and Incentives for EVs

Governments around the world are doing more than just talking about sustainability—they’re putting their money where their mouth is. Tax credits, subsidies, and investments in EV infrastructure aren’t just helping the planet; they’re giving companies like Tesla a massive boost. Investors would be wise to keep an eye on these policies as they continue to shape the future of the industry.

Recent Trends in Tesla Stock Share Market Behavior

Q4 2023 Earnings Report and Its Impact on Tesla Shares

Tesla’s Q4 2023 earnings report was a major moment for investors. Strong revenue growth and expanding margins showed that even in tough economic times, Tesla knows how to keep the profits rolling in. The market responded with a resounding “yes” to Tesla’s future potential.

Cybertruck Production Updates and Their Role in Tesla Stock Fluctuations

The Cybertruck isn’t just another vehicle—it’s a game-changer. Production delays have kept investors on edge, but the anticipation is building. Whether it’s a hiccup or a full-blown storm, how Tesla handles these challenges will have a major impact on its stock performance.

Battery Day Announcements and Their Effect on Tesla Stock Value

Battery Day isn’t just a day—it’s an event. Innovations like cheaper, more efficient batteries are game-changers for the entire EV industry. These advancements aren’t just good for Tesla; they’re good for investors looking to ride the wave of this growing market.

Analyzing Risks and Opportunities in Tesla Stock Share Investment

Assessing Market Volatility for Tesla Shares

Tesla’s stock may be on a roll, but it’s not without its bumps. The EV market is fast-paced and unpredictable, which means investors need to be ready for the ups and downs. Before diving in, ask yourself—how much volatility can you handle?

Regulatory Challenges and Their Potential Impact on Tesla Stock

Tesla’s success isn’t just about innovation—it’s also about navigating a complex regulatory landscape. Changes in policies or increased scrutiny could throw a wrench in the works. Staying informed is key to making smart investment decisions.

Economic Factors Influencing the Demand for Tesla Shares

From interest rates to consumer confidence, economic factors play a big role in shaping demand for Tesla shares. A strong economy could mean more EVs on the road, while an economic downturn could have the opposite effect. Investors need to keep a close eye on these broader trends when planning their strategies.

Long-Term Outlook for Tesla Stock Share Growth

Projections for Tesla’s Market Cap Expansion

The future looks bright for Tesla. As the EV market continues to grow, projections suggest that Tesla’s market cap is set to expand even further. With its strong brand and commitment to innovation, Tesla is well-positioned to capitalize on this trend.

The Role of Innovation in Tesla’s Future Stock Performance

Innovation isn’t just a buzzword for Tesla—it’s the lifeblood of the company. From advancements in battery technology to developments in autonomous driving, these innovations aren’t just about staying ahead; they’re about setting new standards for the entire industry.

Potential Catalysts for Significant Gains in Tesla Shares

There are several catalysts that could drive significant gains in Tesla shares in the coming years. Successful global expansion, increased production of high-demand vehicles like the Cybertruck, and continued advancements in EV technology—all of these have the potential to supercharge Tesla’s stock performance.

How to Stay Informed About Tesla Stock Share Trends

Essential Financial News Sources for Tesla Investors

To stay ahead in the game, investors need to be well-informed. Relying on reputable sources like Bloomberg, Reuters, and CNBC is a must. Don’t forget to keep an eye on Tesla’s official press releases—they often hold the key to understanding the company’s strategic direction.

Key Metrics to Monitor for Tesla Stock Performance

Revenue growth, profit margins, production volumes—these are just a few of the metrics that matter when it comes to Tesla’s stock performance. Keeping tabs on these indicators gives investors a clearer picture of the company’s financial health and its ability to meet expectations.

Tools and Resources for Analyzing Tesla Stock Share Data

From financial analysis platforms to stock market apps, there are plenty of tools available to help investors analyze Tesla stock data. These resources provide valuable insights into trends, risks, and opportunities—everything you need to make informed decisions.

Final Thoughts on Investing in Tesla Stock Shares

Weighing the Pros and Cons of Tesla Stock Investment

Investing in Tesla stock offers both opportunities and challenges. On one hand, there’s the potential for significant growth thanks to Tesla’s leadership in the EV market. On the other hand, factors like market volatility and regulatory risks need to be carefully considered before making any moves.

Tips for Long-Term Success in the Tesla Stock Market

For long-term success, investors should take a patient and informed approach. This means staying updated on industry trends, monitoring key performance metrics, and keeping a diversified portfolio to mitigate risks. By being strategic and disciplined, investors can set themselves up for sustained growth.

The Importance of Staying Informed About Tesla Stock Trends

Staying informed is crucial for any investor considering an investment in Tesla stock. Keeping an eye on industry developments, company announcements, and broader economic conditions helps ensure that decisions are well-informed and aligned with financial goals.

Tesla’s journey continues to be one of innovation, growth, and transformation. As the EV market evolves, so too will the opportunities and challenges for investors in Tesla stock shares. By understanding the key factors shaping this market and staying informed about emerging trends, investors can navigate this dynamic landscape with confidence and achieve long-term success.

Tesla Stock Market Trends: What Investors Need to Know

When it comes to electric vehicles (EVs), Tesla is the name everyone’s talking about. This isn’t just a car company—it’s a tech giant leading the charge toward sustainable energy. If you’re considering investing or just want to stay in the loop, this guide will walk you through everything shaping Tesla’s stock performance right now.

Understanding Tesla Stock Performance

Tesla’s Growth Story: From Start-Up to Market Leader

Tesla didn’t start out as a household name, but its rise has been nothing short of explosive. Since going public in 2010, the company’s stock has soared thanks to groundbreaking innovations like the Model S, Gigafactories, and the futuristic Cybertruck. It’s not just cars they’re selling—it’s a vision for the future.

Major Milestones That Mattered

Tesla hasn’t just been building cars; it’s been setting records. Becoming the world’s most valuable automaker wasn’t an accident—it was the result of relentless innovation and bold moves like achieving full self-driving capabilities. Each milestone isn’t just a win for Tesla; it’s a signal to investors that this company is pushing boundaries.

Why Tesla News Moves Markets

When Tesla drops news, the stock market listens. Whether it’s unveiling a new vehicle or hitting a production milestone, these announcements can send shares soaring—or dipping. That’s why investors keep their antennas up for any updates that might impact Tesla’s trajectory.

What’s Driving Tesla Stock Right Now?

The EV Revolution and Its Impact

The world is shifting toward electric vehicles, and Tesla is at the forefront. As governments crack down on emissions, demand for EVs is surging, putting Tesla in a prime position to benefit. This trend isn’t slowing down anytime soon—making it a key driver of Tesla’s stock growth.

Supply Chain Hiccups: A Big Challenge

Even for a company as dominant as Tesla, supply chain issues can throw a wrench in things. Semiconductor shortages and production delays are real headaches that can affect how well Tesla meets demand—and how its stock performs. Investors need to watch closely as Tesla navigates these challenges.

Competition Heating Up

Tesla’s not the only player in town anymore. Traditional automakers like Ford and GM, along with tech giants like Apple, are jumping into the EV game. While competition is healthy, it means Tesla will need to keep its edge if it wants to maintain its market lead.

Government Policies: Friend or Foe?

Regulations can make or break businesses, and Tesla knows this better than most. Tax credits and infrastructure investments are big wins for the EV sector—but changes in policies could also pose challenges. Staying ahead of these developments is crucial for any investor.

What’s Happening Now?

Q4 2023 Earnings: A Strong Showing

Tesla’s latest earnings report was a hit, showing strong revenue growth and expanding profit margins. This isn’t just good news for the company—it reinforces why investors are so bullish on Tesla’s future.

Cybertruck Delays: Cause for Concern?

The Cybertruck is a big deal for Tesla, but delays in production have some investors worried. Will this vehicle live up to its hype and drive growth—or will it end up being more trouble than it’s worth? The answer could be a key driver of stock performance in the coming years.

Battery Day Breakthroughs

When Tesla talks about battery innovations, investors listen. Cheaper, more efficient batteries aren’t just good for cars—they’re game-changers for the entire EV industry. These advancements keep Tesla ahead of the curve and could boost its stock value even further.

Risks and Rewards: What Investors Should Consider

Dealing with Market Volatility

Tesla’s stock isn’t exactly a safe haven. It’s known for wild swings, which means investors need to be ready for turbulence. If you’re considering jumping in, ask yourself if you can handle the ups and downs that come with it.

Regulatory Headwinds

Tesla operates in a highly regulated industry, and changes in policies—whether at home or abroad—could have big implications. Investors should keep an eye on how regulatory shifts might affect Tesla’s growth plans.

Economic Factors: More Than Just Car Sales

The overall economy plays a role too. High interest rates can make borrowing more expensive, while economic downturns might lead people to hold off on buying luxury vehicles like Teslas. Understanding these broader trends is key to making smart investment decisions.

What’s Next for Tesla Stock?

Market Cap Growth: The Road Ahead

If the EV market keeps growing, Tesla could be in for some serious expansion. With its strong brand and innovative approach, the company is well-positioned to capture even more of this rapidly expanding sector.

Innovation as the Key Driver

Tesla’s success hinges on staying ahead of the curve when it comes to technology. Whether it’s autonomous driving or energy

Tesla Stock Value Today vs. Past Performance: What’s Changed?

Understanding Tesla Stock Value Today: An Overview

If you’re wondering what’s behind Tesla’s stock value these days, you’re not alone. Investors, tech geeks, and financial analysts are all keeping a close eye on this electric vehicle giant. But why? Well, it’s simple: Tesla has turned the automotive industry upside down. They’ve shown us that electric cars aren’t just a future possibility—they’re here now, and they’re changing everything.

The Rise of Tesla as a Market Game-Changer

Back in 2003, Elon Musk and his team set out to do something revolutionary. They wanted to create cars that weren’t just environmentally friendly but also sleek, fast, and fun to drive. And boy, did they succeed! From the original Roadster to the Cybertruck, Tesla has consistently pushed the envelope. Their vehicles aren’t just cars; they’re statements about what the future of transportation could look like.

Key Metrics Driving Tesla Stock Performance

So, what makes Tesla’s stock tick? Well, let’s break it down. Revenue growth, profit margins, vehicle deliveries—these are all biggies. But don’t forget about R&D investments. After all, innovation is the lifeblood of any tech company. Take the Cybertruck, for example. It’s not just a truck; it’s a glimpse into what’s possible when you combine cutting-edge design with sustainable energy.

How External Factors Influence Tesla Stock Value Today

Let’s face it—no company exists in a vacuum. Global economic trends, government policies, and even geopolitical tensions all play their part. For instance, the push for electric vehicles in Europe and Asia hasn’t just been good for the environment; it’s been a major boost for Tesla’s bottom line. And when you’re talking about something as big as international markets, that’s bound to have an impact.

Tesla Stock Value Today: Current Valuation and Trends

So where does Tesla stand right now? Their stock value is a reflection of their market clout, financial health, and future potential. Let’s dive into the numbers and see what they mean for investors.

Analyzing Tesla’s Current Market Cap

Tesla’s market cap is no joke. Just a decade ago, it was relatively modest, but now? They’re one of the most valuable automakers out there. This growth isn’t just about numbers; it’s about confidence. Investors believe in Tesla’s vision and their ability to dominate the EV market.

Breakdown of Tesla Stock Price Drivers (Supply Chain, Innovation)

The supply chain has been both a hurdle and a highlight for Tesla. The pandemic threw some curveballs, but it also showed how crucial vertical integration is. And then there’s innovation—Tesla doesn’t just make cars; they rethink the entire concept of driving. Advances in battery tech and autonomous systems are keeping their stock price on an upward trajectory.

The Role of Quarterly Earnings

Quarterly earnings reports are like a report card for Tesla. Metrics like revenue growth, net profit, and cash flow are under the microscope. Strong numbers can send the stock soaring, while any misses might cause a bit of a dip. But hey, that’s just part of the ride.

Past Performance of Tesla Stock: A Historical Perspective

To understand where Tesla is now, it helps to look back at how far they’ve come. This isn’t just about numbers; it’s a story of innovation and resilience.

From $10 to Over $700: Tesla’s Journey

Tesla’s stock journey is nothing short of remarkable. Starting at around $10 in 2010, it hit an all-time high of over $700 in early 2021. This isn’t just a numbers game; it’s about the broader shift toward sustainability and electric vehicles.

Major Milestones

From the Model S to the Cybertruck, Tesla has been full of surprises. Each milestone wasn’t just a product launch; it was a statement about what the future could hold.

Learning from Market Reactions

Tesla’s announcements don’t just make headlines—they move markets. The unveiling of new models or partnerships has historically sent their stock soaring. Understanding these patterns can help investors anticipate what’s next.

What Has Changed in Tesla’s Business Model?

Tesla isn’t sitting still. Their business model has evolved, adapting to new challenges and opportunities.

Expanding into New Markets

From the Cybertruck to semi-trucks, Tesla is branching out into new territories. This diversification not only broadens their offerings but also solidifies their position as an industry leader.

Beyond Cars: Energy Storage and Solar

Tesla’s reach extends beyond cars. Ventures like the Powerwall and solar systems show a commitment to creating a sustainable energy ecosystem.

Keeping Up with Competitors

The EV market is getting more competitive, with companies like Ford and GM stepping up their game. This isn’t just about keeping pace; it’s about staying ahead of the curve.

The Impact of Regulatory and Market Changes on Tesla Stock

Regulatory changes and market dynamics play a big role in shaping Tesla’s stock value. Let’s explore how these factors influence both investor sentiment and corporate strategy.

Government Policies and Incentives

Governments around the globe are pushing for electric vehicles through subsidies, tax credits, and infrastructure investments. These policies aren’t just good for the environment; they’re a win for Tesla’s sales.

Supply Chain Challenges

The global supply chain has been both a challenge and an opportunity. While disruptions have caused some headaches, they’ve also highlighted the importance of building resilient systems—something Tesla is taking to heart.

Consumer Sentiment

What people think about electric vehicles, sustainability, and innovation directly impacts demand for Tesla’s products—and consequently, their stock price.

The Future Outlook for Tesla Stock: What Investors Should Watch

Looking ahead, Tesla’s stock is likely to be influenced by a mix of opportunities and challenges. Here are some key things investors should keep an eye on.

Growth Areas (Autonomous Driving, Battery Innovation)

Tesla’s focus on autonomous driving and battery tech presents huge growth opportunities. Breakthroughs here could further cement their dominance in the EV market.

Risks and Uncertainties

While the future looks bright, there are risks to consider—everything from rising competition to regulatory changes and economic downturns. Investors should stay vigilant and prepared for market fluctuations.

Maintaining Dominance

Tesla’s ability to stay on top will depend on their capacity to innovate, expand their product lineup, and adapt to changing conditions. Their long-term vision and commitment to sustainability are key factors that should continue to resonate with investors.

Investing in Tesla Stock Today: Tips and Considerations

If you’re thinking about investing in Tesla stock, there’s a lot to consider. Here are some tips to help guide your decision.

Evaluating Your Goals and Risk Tolerance

Before jumping in, take the time to assess your investment goals and risk tolerance. Tesla is known for its volatility, so it’s essential to have a clear strategy and be ready for fluctuations.

Diversification Strategies

While Tesla might be a key part of your portfolio, don’t put all your eggs in one basket. Diversifying across different sectors can help mitigate risk.

Stay Informed

The EV market is dynamic, so it’s crucial to stay informed about the latest developments. Keeping up with industry trends and company news will help you make more informed decisions and capitalize on opportunities as they arise.

Conclusion

Tesla’s current stock value is a reflection of its past achievements, present momentum, and future potential. From its disruptive business model to its innovative approach to sustainability, Tesla continues to be a major player in the automotive industry.

As an investor, understanding what drives Tesla’s performance is crucial for making informed decisions. By staying attuned to market trends, regulatory changes, and company developments, you can navigate the ups and downs of the EV market with confidence.

Whether you’re a long-term holder or new to investing in Tesla, their story serves as a powerful reminder of how innovation and vision can shape the future of transportation. Here’s to what’s next for this groundbreaking company!

Here’s a more conversational and optimized version of the provided text:

—

Understanding Tesla Stock Value Today: An Overview

Tesla’s stock is on everyone’s radar—investors, tech geeks, you name it. Why? Because this company has been a game-changer in the auto industry, redefining what we know about electric vehicles and sustainable energy. But what keeps its stock ticking? Let’s break it down.

Tesla: The Game-Changer

From a small startup to a global icon, Tesla’s journey is nothing short of amazing. Founded in 2003 by Elon Musk and other visionaries, Tesla has been pushing the envelope with electric cars, cutting-edge batteries, and sustainable energy solutions that have captured the world’s imagination.

What Moves Tesla’s Stock?

To understand what drives Tesla’s stock value today, we need to look at key metrics like revenue growth, profit margins, vehicle deliveries, and R&D investments. For example, consistently hitting production targets and releasing innovative products like the Cybertruck have been big wins for its stock performance.

External Factors: The Big Picture

Global economic trends, government policies on EVs, and even geopolitical events can sway investor sentiment. Take Europe and Asia’s incentives for electric vehicles—they’ve been a huge boost for Tesla’s international sales and, in turn, its stock price.

Tesla Stock Value Today: Current Valuation and Trends

So what’s the deal with Tesla’s stock today? Let’s dive into the numbers and see what they mean for investors.

Tesla’s Market Cap: The Numbers Don’t Lie

Tesla’s market cap has skyrocketed over the past decade. From a modest valuation in 2010 to one of the most valuable automakers today, this growth shows investor confidence in Tesla’s long-term vision and its ability to dominate the EV market.

Supply Chain and Innovation: The Drivers

The supply chain has been both a hurdle and an opportunity. While pandemic disruptions temporarily slowed things down, they also underscored the importance of vertical integration. Meanwhile, Tesla’s relentless focus on innovation—like advancements in battery tech and autonomous driving—keeps its stock price climbing.

Quarterly Earnings: The Bottom Line

Quarterly earnings reports are a big deal for Tesla. Investors watch closely for metrics like revenue growth, net profit, and cash flow to gauge the company’s financial health. Strong earnings often lead to positive stock movements, while misses can cause temporary dips.

Past Performance of Tesla Stock: A Historical Perspective

To really get what’s changed with Tesla’s stock value today, we need to look back at its past performance. This historical perspective offers valuable insights into the company’s journey and how far it has come.

Tesla’s Journey from $10 to Over $700

Tesla’s stock price has seen remarkable growth over the years. Starting at just $10 in 2010, it hit an all-time high of over $700 in early 2021. This trajectory reflects not only Tesla’s success but also broader market trends toward sustainable energy and electric vehicles.

Key Milestones That Shaped Its Stock

Several key events have shaped Tesla’s stock performance. The launch of the Model S, the introduction of the Powerwall, and the announcement of the Cybertruck are just a few milestones that sent shockwaves through the market.

Learning from Past Market Reactions

Tesla’s announcements often spark significant reactions in the stock market. For example, the reveal of new vehicle models or partnerships with energy companies has historically led to sharp increases in its stock value. Understanding these patterns can help investors anticipate future movements.

What Has Changed in Tesla’s Business Model?

Tesla’s business model has evolved significantly over the years, adapting to market demands and technological advancements. Let’s explore some of the key shifts that have occurred.

Expanding into New Markets

One notable change is Tesla’s expansion into new vehicle segments like the Cybertruck and Semi-Trucks. These products not only diversify Tesla’s offerings but also reinforce its position as an industry leader.

Beyond Cars: Energy Storage and Solar

Tesla has also expanded beyond electric cars. Ventures into energy storage solutions like the Powerwall and solar panel systems demonstrate a commitment to creating an integrated ecosystem of sustainable energy products.

Competitors on the Rise

As the EV market grows, so does the competition. Companies like Ford, GM, and Rivian are now challenging Tesla’s dominance. This competitive landscape is pushing Tesla to innovate faster and stay ahead of the curve.

The Impact of Regulatory and Market Changes on Tesla Stock

Regulatory and market changes have a big impact on Tesla’s stock value today. Let’s explore how these factors influence investor sentiment and corporate strategy.

Governments Pushing for EVs

Governments around the world are increasingly supporting electric vehicles through subsidies, tax credits, and infrastructure investments. These policies not only boost Tesla’s sales but also reinforce its position as a leader in the EV market.

Supply Chain Challenges: A Double-Edged Sword

The global supply chain has been both a challenge and an opportunity for Tesla. While disruptions have occasionally hindered production, they’ve also highlighted the importance of building resilient supply chains—a lesson Tesla is actively applying to its operations.

Consumer Sentiment: The Final Say

Consumer sentiment plays a crucial role in shaping Tesla’s stock value. Positive perceptions about electric vehicles, sustainability, and innovation often translate into higher demand for Tesla’s products—and consequently, its stock.

The Future Outlook for Tesla Stock: What Investors Should Watch

Looking ahead, Tesla’s stock value will likely be influenced by a mix of opportunities and challenges. Here are some key factors investors should keep an eye on.

<h

The Future of Tesla Stock: Will Its Price Continue to Rise?

The Future of Tesla Stock: Will Its Price Keep Climbing?

Electric vehicles are really taking off right now, and as we look ahead, one question is on everyone’s mind: will Tesla’s stock keep going up? Let’s dive into what’s shaping the future of this groundbreaking company.

What’s Driving Tesla Stock Today?

The EV Revolution and Why It Matters

Tesla is at the heart of a massive shift towards electric vehicles. With global efforts to cut carbon emissions, EVs are booming, and Tesla’s innovative approach has put it firmly in the driver’s seat. This strong demand isn’t just good for sales—it’s pushing the stock price higher too.

How the Economy Affects Tesla

When times are good, investors tend to flock to high-growth stocks like Tesla. But when things get rocky, they might look elsewhere. So how well Tesla can handle these ups and downs will be key to its stock performance.

Regulatory Stuff You Should Know

Government policies play a big role too. Tax breaks for EVs can boost demand, which is great news for the stock. But if regulations get too strict, that could throw a wrench in things. Keeping an eye on what’s happening in policy circles is crucial.

The Big Factors Behind Tesla Stock

Battery Tech and Why It’s a Game-Changer

Tesla’s advancements in battery tech are huge. The 4680 battery, for instance, promises longer range and faster charging—features that keep customers excited and investors happy.

Going Global: Tesla’s Next Move

Expanding into new markets like Asia and Europe is a smart move. Success in these regions could really boost revenue and market share, giving the stock a nice lift.

Supply Chain Smarts

Managing the supply chain effectively is no easy feat. Any hiccups—like shortages or delays—can affect profits and, in turn, the stock price. So how well Tesla handles this will be vital.

Money Matters: The Financial Side of Things

Tesla’s Earnings Report Card

If there’s one thing investors watch closely, it’s revenue growth and profitability. Strong earnings often translate to a rising stock price, so these numbers are super important.

Elon Musk’s Tweets: The Good, the Bad, and the Ugly

Tesla’s stock is famously sensitive to Elon Musk’s tweets. A single post can send it soaring or plummeting. It’s a double-edged sword—great for short-term gains but a rollercoaster ride overall.

Debt and How It Weighs In

Tesla’s debt levels are something to keep an eye on. While it can fund growth, too much of it could be risky. Investors need to balance the potential benefits with the risks involved.

The Competition: Who’s Chasing Tesla?

Traditional Automakers Are Catching Up

Ford and GM are ramping up their EV efforts, which means more competition for Tesla. Staying ahead will require constant innovation and strong brand loyalty.

New Players in the EV Game

Startups and tech giants are entering the EV space, bringing fresh competition. Tesla’s ability to adapt and innovate will determine if it can maintain its lead.

When Competitors Innovate

If competitors make big strides in areas like autonomous driving or battery tech, that could shake things up. Tesla needs to keep pushing boundaries to stay on top.

Tech Innovation: The Heart of Tesla’s Success

Autonomous Driving: The Future is Now

Tesla’s Full Self-Driving features are a big draw. Continued progress in this area could really boost demand and keep investors excited.

Energy Storage: Diversifying for Growth

Products like the Powerwall are opening up new revenue streams. Success in this area can provide steady income, which is great for overall growth.

The Cybertruck Hype Train

With its unique design and features, the Cybertruck has been generating a lot of buzz. If it hits the market successfully, that could really give the stock a boost. But any delays might turn some investors sour.

Investor Sentiment: What’s Everyone Thinking?

Social Media’s Role in Stock Swings

Tesla is no stranger to viral moments on social media, especially thanks to Elon Musk’s tweets. These can create a lot of volatility, so investors need to stay sharp and not get caught up in the hype.

Speculation vs. Reality

Speculation about Tesla’s future often drives stock movements. While it’s fun to imagine all the possibilities, staying grounded with realistic projections is key for smart investing.

Looking Ahead: What Lies in Store?

Short-Term vs. Long-Term Outlook

In the short term, things like earnings reports and news events can cause a lot of波动。But long-term growth depends on market expansion and tech advancements. Investors should align their strategies with their investment goals.

Risks to Keep in Mind

Competition, regulations, economic downturns—these are all risks that could impact Tesla’s stock. Supply chain issues or production delays might also affect profitability. Staying informed is crucial for managing expectations.

Sustainability: The Big Picture

As concerns about climate change grow, demand for EVs is likely to rise. This bodes well for Tesla and could lead to continued stock price appreciation as the company stays aligned with global sustainability goals.

So will Tesla’s stock keep climbing? Well, it depends on a mix of market trends, financial performance, tech innovations, and how the company navigates competition. While there are challenges ahead, Tesla’s strategic moves and strong market position suggest some exciting opportunities down the line. Stay informed and keep an eye on these key factors to make smart investment decisions.

The Rise and Fall of Tesla’s Market Price: A Historical Perspective

The Rise and Fall of Tesla’s Market Price: A Historical Perspective

How Tesla Became the Disruptor of the Car Industry

When Elon Musk first envisioned Tesla, it wasn’t just about making cars—it was about changing the world. Founded in 2003 by Martin Eberhard and Marc Tarpenning, with Musk joining as chairman later that year, Tesla set out to prove that electric vehicles (EVs) could be both luxurious and accessible. This wasn’t just a car company; it was a bold statement about the future of mobility and sustainability.

Tesla’s Early Days: A Visionary Start with Some Hiccups

From day one, Tesla had a clear mission: to disrupt the automotive industry and lead the charge toward electrification. The early days were marked by big ambitions and even bigger challenges. Musk’s leadership brought both brilliance and controversy, as he pushed the boundaries of what was possible in the EV space. The company’s first car, the Roadster, was a game-changer, proving that electric cars could be powerful, efficient, and desirable.

The IPO, Production Struggles, and Skepticism

Tesla went public in 2010 with an IPO that raised $226 million. At the time, the stock price was around $17 per share, and the company had a market cap of approximately $2 billion. But the road ahead wasn’t smooth. Production hiccups, particularly with the Model S, led to delays and skepticism from investors and analysts. Many wondered if Tesla could survive as a standalone automaker, let alone thrive in an industry dominated by century-old companies.

The 2015 Price Drop: A Bold Move That Paid Off

In 2015, Musk pulled off a masterstroke: he dropped the price of the Model S and Model X. This decision was met with mixed reactions. While some saw it as a strategic way to make EVs more accessible and gain market share, others viewed it as a sign of desperation. But history has proven this move was genius. By making its vehicles more affordable, Tesla attracted a broader customer base and solidified its position in the EV market.

How Tesla Grew from a Niche Player to a Global Giant

Over the years, Tesla has gone from being a small player to becoming one of the most influential companies in the automotive industry. This growth was driven by innovation, strategic product launches, and aggressive expansion into new markets.

The Model S Launch: A Game-Changer for Tesla

When the Model S debuted in 2012, it wasn’t just another car—it was a technological marvel. With its all-wheel drive, advanced battery technology, and sleek design, the Model S redefined what an electric vehicle could be. The launch of the Model S marked a turning point for Tesla, as it began to gain widespread recognition and admiration. This momentum carried over into the stock market, with Tesla’s share price gradually climbing as investors took notice of its groundbreaking innovation.

Expanding the Product Line: From Model X to Model 3

Tesla continued to evolve its product lineup with the introduction of the Model X in 2015 and the Model 3 in 2017. The Model X, with its Falcon-wing doors and advanced safety features, showcased Tesla’s commitment to innovation and luxury. Meanwhile, the Model 3 was designed to be more affordable, targeting a broader audience and helping to solidify Tesla’s position as a mainstream automaker.

Tesla’s Big Move into China

China has become a critical market for Tesla, and the company’s entry into this massive automotive market was a game-changer. By building a Gigafactory in Shanghai and launching vehicles tailored to Chinese preferences, Tesla positioned itself as a serious competitor in one of the world’s largest automotive markets. This strategic move not only boosted sales but also sent a clear message to investors about Tesla’s global ambitions.

The COVID-19 Pandemic: How Tesla Emerged Stronger

Like many industries, the automotive sector was hit hard by the COVID-19 pandemic. But Tesla didn’t just survive—it thrived. The company’s stock price experienced a remarkable surge in 2020, despite the challenges.

Production Challenges and Supply Chain Disruptions

The early days of the pandemic were tough for everyone, including Tesla. Factories were forced to shut down, and global logistics came to a standstill. But Tesla’s vertical integration model and focus on innovation helped it weather the storm better than many competitors.

Why Tesla Outperformed Traditional Automakers

While traditional automakers struggled with declining sales and layoffs, Tesla demonstrated remarkable resilience. The company’s focus on online sales, direct-to-consumer distribution, and a loyal customer base allowed it to maintain momentum even during the darkest days of the pandemic.

The Surprising Q2 2020 Recovery

One of the most surprising developments during the pandemic was Tesla’s ability to turn a profit in Q2 2020. Not only did the company report its first quarterly profit since late 2019, but it also announced plans for a stock split, which further fueled investor enthusiasm. By the end of 2020, Tesla’s market cap had soared past $600 billion, making it the most valuable automaker in the world.

Tesla’s Stock Price: A Ride Full of Ups and Downs

Tesla’s stock price has always been a rollercoaster ride, with investor sentiment swinging wildly based on news, earnings reports, and broader market conditions. This volatility is both a reflection of Tesla’s disruptive nature and a testament to the high stakes in the automotive industry.

The Role of Short Interest in Tesla’s Stock Price

Short interest has played a significant role in Tesla’s stock price fluctuations. At various points, short sellers have bet against Tesla, believing that its market valuation was unsustainable. However, these bets often backfired, as Tesla continued to exceed expectations and deliver strong financial results.

The Decline of Short Interest: The Rise of “Tesla Bulls”

Over time, short interest in Tesla has declined significantly, as more investors have come to believe in the company’s long-term potential. This shift in sentiment has been reflected in the stock price, which has continued to rise despite occasional dips.

Comparing Tesla to Traditional Automakers

Tesla’s valuation is often compared to that of traditional automakers, with many analysts questioning whether the company’s market cap reflects its true value. While some argue that Tesla’s stock price is overvalued, others point to the company’s innovative technology, growing market share, and long-term vision as reasons for optimism.

Tesla’s Challenges: Navigating a Volatile Market

Tesla’s journey hasn’t been without its challenges. From production delays to regulatory hurdles, the company has faced numerous obstacles along the way. These challenges have tested Tesla’s ability to adapt and innovate in a rapidly changing industry.

Supply Chain Issues: A Recurring Theme

Supply chain issues have been a recurring theme for Tesla, particularly as the company has scaled up its production. From semiconductor shortages to logistics bottlenecks, these challenges have occasionally impacted both production and stock price. However, Tesla’s ability to work closely with suppliers and invest in new manufacturing technologies has helped mitigate some of these risks.

Rising Competition from Legacy Automakers

Tesla is no longer the only player in the EV market. Traditional automakers like GM, Ford, and Volkswagen have all launched their own electric vehicles, creating a more competitive landscape. While this increased competition could pose a threat to Tesla’s dominance, it also validates the company’s vision of a future where EVs are mainstream.

Regulatory Hurdles: Shaping Tesla’s Market Position

Regulatory hurdles have also played a role in shaping Tesla’s market position. From government incentives for EV adoption to stricter emissions standards, the regulatory environment has both helped and hindered Tesla’s growth. The company has been vocal about its belief that regulations should favor sustainable energy solutions, and it continues to advocate for policies that support the transition to electric vehicles.

What’s Next for Tesla’s Market Price?

Looking ahead, Tesla’s market price will likely continue to be influenced by a mix of growth drivers, risks, and uncertainties. The company has ambitious plans for the future, but achieving them won’t be easy.

Growth Drivers: Cybertruck, FSD, and Renewable Energy Ambitions

One of Tesla’s biggest growth drivers is its lineup of upcoming products, including the Cybertruck, Semi, and Roadster. These vehicles represent a significant expansion of Tesla’s product portfolio and could help the company capture new market segments. Additionally, Tesla’s Full Self-Driving (FSD) technology and renewable energy initiatives are expected to play a key role in driving future growth.

Risks and Uncertainties: Economic Downturns and Battery Innovation

Despite its many strengths, Tesla isn’t immune to risks. An economic downturn could impact consumer spending on luxury vehicles like the Model S and Model X, while competition in the EV space is likely to intensify as more automakers enter the market. Additionally, advancements in battery technology could either help or hurt Tesla, depending on how they’re implemented.

Musk’s Vision for the Future: A Roadmap for Continued Disruption

Elon Musk’s vision for the future remains as ambitious as ever. From colonizing Mars to revolutionizing transportation, Musk has no shortage of big ideas. While some of these ideas may seem far-fetched, they reflect a belief in the importance of pushing boundaries and challenging the status quo.

Conclusion: The Ride So Far and What Lies Ahead

Tesla’s journey from a risky investment to a market leader has been nothing short of remarkable. Along the way, the company has faced numerous challenges, but it has consistently demonstrated resilience and innovation. As we look ahead, the question is: where will Tesla go next? The answer lies in its continued commitment to disrupting the automotive industry and accelerating the world’s transition to sustainable energy.

Whether you’re an investor, a car enthusiast, or simply someone interested in the future of mobility, Tesla’s story is one worth watching. With its ambitious roadmap, innovative technology, and unwavering vision, Tesla is poised to continue shaping the automotive landscape for years to come.

The Rise and Fall of Tesla’s Market Price: A Historical Perspective

The Rise of Tesla: A Disruptive Force in the Automotive Industry

When Elon Musk first envisioned Tesla, it wasn’t just another car company; it was a bold statement about the future of mobility. Founded in 2003 by Martin Eberhard and Marc Tarpenning, with Musk joining as chairman later that year, Tesla set out to prove that electric vehicles (EVs) could be both luxurious and mass-market viable. This vision wasn’t just about cars—it was about accelerating the world’s transition to sustainable energy.

The Birth of Tesla and Its Vision for the Future

From its inception, Tesla had a clear mission: to disrupt the automotive industry and lead the charge toward electrification. The company’s early days were marked by ambitious goals and significant challenges. Musk’s leadership brought both vision and controversy, as he pushed the boundaries of what was possible in the EV space. The company’s first vehicle, the Roadster, was a game-changer, showcasing that electric cars could be powerful, efficient, and desirable.

Early Days: IPO, Production Hiccups, and Market Skepticism

Tesla went public in 2010 with an IPO that raised $226 million. At the time, the stock price was around $17 per share, and the company had a market cap of approximately $2 billion. However, the road ahead wasn’t smooth. Production hiccups, particularly with the Model S, led to delays and skepticism from investors and analysts. Many wondered if Tesla could survive as a standalone automaker, let alone thrive in an industry dominated by century-old companies.

The 2015 Price Drop: A Strategic Move to Capture Market Share

In 2015, Tesla made headlines with a bold move: it dropped the price of its Model S and Model X vehicles. This decision was met with mixed reactions. While some saw it as a strategic way to make EVs more accessible and gain market share, others viewed it as a sign of desperation. However, history has shown that this move paid off. By making its vehicles more affordable, Tesla attracted a broader customer base and solidified its position in the EV market.

The Growth Phase: From Model S to Global Dominance

Over the years, Tesla has transformed from a niche player into a global automotive giant. This growth phase was driven by a combination of innovation, strategic product launches, and aggressive expansion into new markets.

The Launch of the Model S and Its Impact on Tesla’s Market Price

When the Model S debuted in 2012, it wasn’t just another car—it was a technological marvel. With its all-wheel drive, advanced battery technology, and sleek design, the Model S redefined what an electric vehicle could be. The launch of the Model S marked a turning point for Tesla, as it began to gain widespread recognition and admiration. This momentum carried over into the stock market, with Tesla’s share price gradually climbing as investors took notice of its groundbreaking innovation.

Expanding the Product Line: Introducing the Model X and Model 3

<

Tesla Market Price: What Investors Need to Know

Introduction to Tesla Market Price

Tesla, the electric vehicle (EV) pioneer led by Elon Musk, has been a hot topic among investors for years. Its stock price has seen dramatic ups and downs, capturing the attention of both seasoned investors and newcomers alike. But why does it matter? What’s causing all these ups and downs? And should you even care about Tesla’s market price?

What is Tesla’s Current Market Price?

Tesla’s stock price is like a rollercoaster—constantly moving based on real-time trading activity. You can check platforms like Bloomberg, Yahoo Finance, or your brokerage account for the latest numbers. But here’s the thing: understanding what’s driving those numbers is just as important as knowing them.

Why Should Investors Care About Tesla’s Market Price?

Tesla isn’t just another car company; it’s a game-changer in the automotive industry and a leader in sustainable energy. Its stock price reflects how investors feel about its future growth, technological breakthroughs, and ability to stay ahead in an ever-evolving market. Whether you’re holding onto shares for the long haul or trading short-term, staying in the know is essential.

Key Factors Influencing Tesla Market Price

Financial Performance and Earnings Reports

Tesla’s quarterly earnings reports are a big deal for investors. Metrics like revenue growth, profit margins, and cash flow tell us how healthy the company really is. For example, if sales spike or profits take a nosedive, it can send the stock price soaring—or crashing.

Industry Trends and Competition

The EV market is getting crowded. Traditional automakers like Ford and GM are ramping up their electric vehicle production, while new players like Rivian and Lucid are making waves. These trends can make or break investor confidence in Tesla’s long-term dominance.

Global Events and Supply Chain Issues

External factors like supply chain disruptions, geopolitical tensions, or changes in government policies can also shake things up. For instance, tariffs on imported parts or labor shortages at factories could temporarily slow production—and that could have a ripple effect on the stock price.

Historical Context of Tesla Market Price

Volatility in Tesla’s Stock Price Over the Years

Tesla’s stock has been anything but predictable. From its initial public offering (IPO) in 2010 to today, the company has had its share of highs and lows. Understanding this volatility is key for anyone thinking about investing.

Major Milestones That Impacted Tesla’s Market Price

Landmark moments like the launch of the Model S, the expansion of Gigafactories, or regulatory approvals have all played a role in shaping Tesla’s stock price. On the flip side, challenges like production delays or leadership changes have caused some serious turbulence.

Expert Opinions on Tesla Market Price

What Analysts Are Saying About Tesla’s Valuation

Financial analysts are always weighing in on Tesla’s valuation. Some think it’s way overpriced compared to its fundamentals, while others believe it’s undervalued given its growth potential. These differing opinions show just how complex investing in Tesla can be.

Potential Risks and Opportunities for Investors

Investing in Tesla comes with risks—like market volatility and regulatory challenges. But there are opportunities too, especially if you’re willing to ride the waves of uncertainty. Breakthroughs in battery technology or successful international expansion could be game-changers.

Future Projections for Tesla Market Price

Analyst Forecasts and Growth Expectations

Analysts are painting very different pictures for Tesla’s future. Some see continued growth driven by increasing EV adoption, while others are more cautious. These forecasts can help investors prepare for what’s ahead.

Impact of New Product Launches and Innovations

Tesla’s pipeline of new products—like the Cybertruck or upcoming affordable models—could have a huge impact on its stock price. Innovation in areas like autonomous driving technology is also likely to influence how investors feel about Tesla.

How to Invest in Tesla Market Price

Strategies for Long-Term Holders

If you’re in it for the long haul, strategies like dollar-cost averaging or reinvesting dividends might be your best bet. These approaches can help you ride out short-term volatility and capitalize on Tesla’s potential growth.

Tips for Short-Term Traders

For short-term traders, technical analysis is key. Tracking indicators like moving averages or RSI (Relative Strength Index) can give you a better sense of where the stock might be headed. Staying updated on news and market trends is also crucial.

Risks Associated with Investing in Tesla Market Price

Market Volatility and Its Effects

Tesla’s stock price can swing wildly based on news or market sentiment. This volatility makes it a high-risk investment, especially for those with a lower tolerance for uncertainty.

Regulatory Challenges and Their Impact on Stock Price

Government policies—like tax incentives for EVs or stricter emissions regulations—can influence Tesla’s stock price. But regulatory hurdles like safety investigations or trade disputes could also pose serious risks.

Staying Updated on Tesla Market Price

Best Sources to Follow Tesla’s Stock Performance

To stay in the loop about Tesla’s stock price, check out reputable financial news outlets like CNBC or Reuters. Subscribing to newsletters from brokerage firms or using apps like Robinhood can also keep you up-to-date on real-time changes.

Tools and Resources for Monitoring Market Trends

Tools like Google Finance, TradingView, or Bloomberg Terminal let you track Tesla’s stock price in real time. Setting up alerts for news related to Tesla is another great way to stay ahead of the curve.

Conclusion

Tesla’s market price is shaped by a mix of factors—from financial performance and industry trends to global events and expert opinions. Whether you’re a long-term investor or a short-term trader, understanding these dynamics is crucial for making smart decisions. By staying informed and using solid investment strategies, you can navigate the ups and downs of Tesla’s stock price with confidence.

Why Tesla’s Market Price is Soaring (or Dipping)

What Drives Tesla’s Stock Price?

If you’re keeping an eye on Tesla, you might wonder why its stock price behaves the way it does. At its heart, this company has turned the automotive world upside down by betting big on electric vehicles (EVs) and cutting-edge tech. And investors are paying close attention to how these moves shape the value of their shares.

Why Tesla’s Innovation Matters

Tesla’s reputation as an EV leader is no accident—and it’s a huge part of what keeps its stock price ticking. From better battery life to autonomous driving features, they’re always pushing boundaries. And let’s not forget the designs—they make cars that people actually want to drive. All this innovation doesn’t just attract customers; it also gets investors excited about Tesla’s long-term growth potential.

How Rules and Regulations Impact Tesla

Policymakers hold a lot of sway over Tesla’s fortunes. Incentives like tax breaks for EVs can give their sales a nice boost, which is always good for the bottom line. But changes in regulations or trade policies can throw a wrench in things too. Staying on top of these shifts is key to understanding what’s driving (or slowing down) Tesla’s stock price.

Why Financial Health Matters

When it comes to Tesla’s value, money talks—and investors are listening closely. Strong earnings reports, growing revenue streams, and smart cost management all send positive signals to the market. But if there’s any stumble in the financials, that can cause some serious dips. That’s why digging into their financial statements is a must for anyone trying to get a handle on where Tesla’s headed.

How Competition Shapes Tesla’s Value