Tesla battery stock price Trends: Forecasting the Next Big Move in Clean Energy

Tesla Battery Stock Price: Ushering in a New Era of Clean Energy

Have you ever stopped to think about how advanced technology and sustainable energy go hand in hand? When you hear “tesla battery stock price,” it’s not just a number flashing on a screen—it’s a sign of the global shift toward cleaner, greener energy. Investors, policymakers, and eco-enthusiasts are buzzing about Tesla’s groundbreaking battery tech, which is redefining not only automotive standards but also how we store and use energy. In a nutshell, this trend is more than just financial talk; it’s a powerful movement towards a more sustainable future powered by innovation.

What Does Tesla Battery Stock Price Actually Mean?

At its core, the term “tesla battery stock price” is about how the market values Tesla’s strides in battery technology. It’s far more than just a ticker number; it reflects widespread confidence in Tesla’s ability to lead an energy revolution. Many see these battery advances as a major growth trigger—not only energizing Tesla’s future but also electrifying the entire clean energy sector. It’s a dynamic barometer that captures everything from solid financial performance to the revolutionary shifts in how we consume energy.

How Tesla Battery Tech is Sparking a Clean Energy Transformation

Tesla isn’t just improving batteries; it’s rethinking how we harness and store energy. With every innovative leap, Tesla is pushing boundaries and stirring quite a bit of excitement among investors. Their ability to store renewable energy more efficiently has brought down costs and streamlined power management for larger grids. This isn’t just theory—it’s our tangible path to a sustainable future. As investors keep a close eye on Tesla, they are hopeful that these tech breakthroughs will pave the way for lasting market advantages and profitability. The stock’s movements tell a fascinating story of investor confidence meshed with emerging opportunities in renewable energy.

Key Factors Shaping Tesla Battery Stock Price Trends

There are several forces at play when it comes to the ups and downs of Tesla’s battery stock price. For one, the pace of innovation is a major driver—each breakthrough in battery efficiency or cost reduction can set the market abuzz. Market sentiment, driven by investor optimism or caution, also plays a big part. Regulatory shifts, whether welcoming or challenging, add another layer of complexity, and macroeconomic factors like interest rates and trade tensions further stir the pot. Together, these factors create a dynamic and sometimes unpredictable landscape, making the future of Tesla’s stock as exciting as it is uncertain.

A Walk Down Memory Lane: The Evolution of Tesla Battery Stock Price

Taking a look back at Tesla’s journey with battery stock trends reveals a riveting story of innovation, resilience, and transformation. The early days were marked by bold bets and groundbreaking leaps that captured the market’s imagination. Sure, there were moments of volatility and uncertainty, but each twist and turn taught valuable lessons and laid the groundwork for Tesla’s robust standing today. This historical narrative isn’t merely a series of price changes—it’s a mirror to how investor perceptions have grown alongside Tesla’s technological milestones.

Pioneering Moments in Tesla’s Battery Journey

The early chapters of Tesla’s battery story were nothing short of revolutionary. Initially, the market was understandably cautious; after all, applying battery tech to cars and energy storage was a bold new frontier. But as each prototype rolled out and performance improved, investor confidence steadily built. These formative steps not only set Tesla apart from traditional carmakers but also signaled a long-term vision for a sustainable energy future. Despite the rollercoaster of volatile price movements, those early breakthroughs created a foundation of excitement and optimism that continues to drive Tesla’s market performance today.

The Impact of Regulations and Market Conditions

Government policies and market conditions have always been the backdrop to Tesla’s battery stock story. Supportive regulations, like tax incentives for renewable energy, can spark a surge in investor enthusiasm, while regulatory uncertainty might cause a bit of a dip in confidence. It’s a balancing act, where the interplay of economic policies and direct governmental initiatives keeps everyone on their toes. Add in the ever-changing market competition and shifting consumer tastes, and you have a complex, yet fascinating, mix that shapes Tesla’s stock narrative.

Lessons We’ve Learned from Tesla’s Stock Movements

The ups and downs of Tesla’s battery stock price have taught investors one key lesson: aligning technological innovation with smart market execution is crucial. Past volatility has shown that investor sentiment is quick to react not only to Tesla’s own performance but also to broader shifts in the economy. These experiences highlight that adaptability is key in the rapidly evolving world of clean energy. Each phase of market response has underscored the importance of robust innovation and strategic planning in facing the uncertainties that naturally accompany breakthrough technologies.

Tesla Battery Stock Price Today: What’s the Story?

Right now, Tesla’s battery stock price is a hot topic among investors and energy buffs alike. Recent trends show that its value is closely tied to advancements in battery technology, shifts in regulation, and broader global economic currents. The current landscape reflects growing confidence in Tesla’s long-term plans, even as investors remain cautious about the inherent risks of fast-paced technological change. As Tesla continues pushing the envelope in energy storage, the market keeps watching closely, balancing the allure of explosive growth against the realities of an unpredictable tech-driven world.

Breaking Down Today’s Valuation Metrics

Today’s valuation metrics for Tesla’s battery stock present a multifaceted picture of market expectations. Indicators such as P/E ratios, market cap, and forward earnings estimates have all been adjusted to account for the high stakes of Tesla’s innovations. Investors are drawn to these figures because they capture both immediate financial health and the enormous potential for long-term growth. It’s this mix of financial rigor and the promise of a cleaner energy future that keeps the market captivated and makes Tesla’s stock a true bellwether for the renewable energy revolution.

The Power of Investor Sentiment

Investor sentiment is one of the biggies when it comes to Tesla’s battery stock price. Optimism about the future of clean energy often drives hopeful buying, whereas economic jitters can lead to short-term pullbacks. In today’s fast-moving market, even a small shift in sentiment can send ripples across the stock’s trajectory. It’s not just the hard numbers; the stories spread via media and expert commentary also play a huge role in shaping how investors feel about Tesla’s prospects.

The Role of Technological Breakthroughs

Tesla’s relentless push for technological innovation is really what sets it apart. Every time the company scores a win in battery performance—whether it’s a boost in energy density or a drop in production costs—investors take notice. These breakthroughs are the result of a mix of extensive research, smart collaborations, and sheer engineering grit. In the eyes of investors, each innovation not only promises future cost savings but also signals a growing market share, which naturally justifies a higher stock valuation over time.

Peering into the Future: What Lies Ahead for Tesla Battery Stock Price?

Looking forward, predicting Tesla’s battery stock price is like assembling a puzzle where market trends, tech advancements, and economic factors all blend together. While no one can predict the future with total certainty, experts use a mix of historical data and current market signals to guide their forecasts. The excitement about Tesla’s battery developments, combined with a global shift toward renewable energy, creates an intriguing environment for long-term growth. For those who keep a close watch on market trends and tech updates, the next big move in this sector might just be right around the corner.

Emerging Market Forces at Work

New market forces are already taking shape and influencing the future of Tesla’s battery stock price. With a global push toward renewable energy and increasing government support, there’s a growing demand for Tesla’s cutting-edge battery tech. International markets, too, are warming up to green energy initiatives, amplifying the momentum behind Tesla’s innovations. Analysts believe these forces will only intensify, making it all the more important for investors to monitor both the local and global landscapes.

Tech Innovations Driving Forecasts

From breakthroughs in battery chemistry to smarter energy management systems, tech innovations are the heartbeat of Tesla’s stock price predictions. Every time Tesla rolls out an upgrade that enhances battery performance, analysts adjust their forecasts with a healthy dose of optimism. These technological strides don’t just lower costs—they also position Tesla to capture a larger slice of the market, which naturally feeds into higher stock valuations over the long haul.

Geopolitical and Economic Weather

We can’t ignore the bigger picture either. Geopolitical tensions, trade disputes, and shifting economic policies can all send shockwaves through Tesla’s battery stock price. Even though Tesla’s innovation provides some insulation, the interconnected nature of the global economy means that external events can quickly change the market’s mood. Savvy investors are always on the lookout for these shifts, understanding that even in a booming sector like clean energy, external factors can have a big impact.

Expert Predictions and Forecast Models

There’s a wealth of expert forecasts and sophisticated models that try to pinpoint where Tesla’s battery stock price is headed. These analyses combine regression models, scenario planning, and probability assessments to offer a glimpse into the future. While many analysts are bullish on Tesla’s prospects due to its continuous innovation and strong positioning in the clean energy space, they also caution that unpredictable global events can tweak the numbers. Still, for many, these forecasts provide a useful roadmap for navigating the choppy waters of tech investments.

Tesla Battery Stock Price in Today’s Clean Energy Policy Landscape

Government policies and regulatory frameworks are key players in the story of Tesla’s battery stock price. Around the world, governments are rolling out initiatives to promote green technologies, which in turn, help reduce barriers and foster innovation. For Tesla, this translates into a supportive environment where its tireless efforts in advancing battery technology can really pay off. Investors recognize that sustained backing from governments can be a major boost, reinforcing the long-term potential of Tesla’s stock in the renewable energy arena.

How Regulations Can Make or Break a Stock

It’s no secret that government regulations can have an immediate, sometimes dramatic, impact on Tesla’s battery stock value. When policies friendly to renewable energy—like tax breaks or research grants—are introduced, investor confidence tends to skyrocket. On the flip side, new restrictions might set off caution bells. The interplay of regulatory support and market reaction creates an exciting environment where every move by policymakers is watched closely, often reflecting directly on Tesla’s market performance.

Sustainability Trends Giving Tesla a Boost

With sustainability becoming a global mantra, every step forward in battery innovation gets amplified. As companies and countries ramp up their efforts to cut down on carbon emissions, Tesla is regularly in the spotlight. Positive media coverage and a growing base of environmentally conscious investors mean that every new sustainability milestone can act as a catalyst for a surge in Tesla’s stock. At the end of the day, Tesla’s commitment to advancing clean energy isn’t just good for the planet—it’s also a big win for its market reputation.

Investment Strategies Around Tesla Battery Stock Price

Many investors have carved out strategies that center around the transformative potential of Tesla’s battery stock price. With a keen eye on long-term growth, it’s no wonder that Tesla often becomes a cornerstone in a diversified clean energy portfolio. Given the inherent ups and downs of tech investments, balancing risk with growth potential is key. By keeping tabs on evolving battery technologies and staying informed about supportive policies, investors can use a mix of technical analysis, historical trends, and expert insights to make well-rounded decisions.

Looking Ahead: Long-Term Growth Potential

When it comes to long-term growth, Tesla’s battery stock price tells a promising story. The company’s relentless pursuit of innovation, paired with a worldwide trend toward renewable energy, makes it a compelling pick for growth-oriented investors. Sure, there might be some short-term jitters, but the long-term outlook remains robust, supported by a vision for a greener, more sustainable future. For those willing to ride the wave of rapid innovation, Tesla’s journey is as exciting as it is rewarding.

Top Strategies in nvidia stock investing for Long-Term Growth

Introduction to Nvidia Stock Investing

Diving into Nvidia stock investing has captured the attention of countless investors, thanks to its groundbreaking technology and robust market footprint. Think of this as your friendly guide to why putting your money into Nvidia might just be a golden ticket. As we hurtle towards a tech-driven future, Nvidia consistently shines as a front-runner in graphics processing and artificial intelligence. In this post, we’ll chat about some key strategies designed to help you grow your holdings over time, all while offering easy-to-digest insights perfect for both newbies and seasoned investors. Whether you’re just starting out or already well-versed in the world of investments, you’ll come away with practical, research-backed tips to navigate this competitive playing field.

Understanding the Importance of Nvidia Stock Investing

It’s hard to overstate the value of investing in Nvidia stocks, especially as technological breakthroughs continue to fuel market momentum. Nvidia has a knack for pushing the boundaries in computing tech, making waves in sectors like gaming, data centers, and even the automotive world. Their heavy investment in R&D speaks volumes about their potential to keep winning in the long run. By opting into Nvidia stocks, you’re not just buying into a company—you’re aligning yourself with a blend of tech-savvy innovation and solid financial performance. It’s all about catching the wave of emerging tech trends while riding a market that’s built to last.

Recognizing Long-Term Growth Opportunities

Spotting long-term growth in Nvidia stock investing means taking a good, hard look at the company’s vision and constant innovation. Whether it’s pushing boundaries in AI, autonomous driving, or high-performance computing, Nvidia is busy laying the groundwork for big things ahead. Sure, the market might toss in a few bumps along the way, but the overall trend is one of steady upward movement. Follow their strategic moves and investments in research, and you’ll see how these incremental gains add up over time, offering substantial opportunities for those ready to stay patient and committed.

Fundamentals of Nvidia Stock Investing

Key Financial Metrics and Valuation

At the heart of a sound Nvidia stock strategy is a firm grasp of the essential financial metrics. Investors often look at figures like earnings per share, price-to-earnings ratios, and revenue growth to get a handle on the company’s valuation and its potential for future success. Nvidia often struts out impressive numbers that give investors a boost of confidence, but it’s always a game of balance between risk and reward. Savvy investors take into account both historical performance and future projections, checking these metrics periodically to stay in tune with market trends and Nvidia’s evolving journey.

Analyzing Company Performance and Growth Trends

When it comes to gauging Nvidia’s performance, the devil is in the details—think quarterly reports, earnings calls, and investor presentations. The company’s steady growth across various sectors cements its position as a leader in AI and GPU computing. Keeping an eye on trends like revenue diversification and global expansion can really help investors spot opportunities. With frequent updates on new product launches and strategic partnerships, you get a clearer picture of how rapid tech advancements might boost Nvidia’s profitability and market share. This sort of detailed analysis creates a well-rounded view of the company’s ongoing progress.

Evaluating Market Position and Competitors

In Nvidia stock investing, understanding who you’re up against in the competitive arena is key. Nvidia is at the cutting edge of a fast-moving industry where competitors are always innovating. By comparing Nvidia’s technology, patent strength, and market share with that of its rivals, you can better appreciate its competitive edge. It’s not just about how well Nvidia is doing—it’s also about how other major players are keeping up with the pace of change. Such a comparative analysis can help you decide whether Nvidia’s current lead will continue to pay off or if rivals might eventually catch up.

Strategy Formulation for Nvidia Stock Investing

Assessing Your Risk Tolerance

Crafting your personal investment strategy starts with a good look at your own risk tolerance. Like any equity investment, Nvidia stock investing carries both upsides and downsides. It’s wise to assess your financial situation, how long you plan to invest, and what’s happening in the broader market before taking the plunge. Despite Nvidia’s impressive growth, the tech sector can be a bit of a rollercoaster. By understanding how much risk you’re comfortable with, you can decide if Nvidia fits into your portfolio and figure out when to ride out the storms or jump on emerging opportunities.

Setting Realistic Long-Term Goals

Next up is setting goals that are not only inspiring but also achievable over the long haul. It’s not about chasing quick profits—it’s about building a strategy that aligns with what you truly want to accomplish, whether it’s capital appreciation, retirement planning, or simply adding diversity to your portfolio. Regularly rethinking your goals helps you adjust as market conditions shift and your personal financial landscape evolves. A well-planned, long-term outlook keeps your expectations rooted in both market realities and your individual circumstances.

Research Techniques in Nvidia Stock Investing

Utilizing Technical Analysis Tools

Technical analysis is like having a trusty roadmap when exploring the world of Nvidia stock investing. Tools such as moving averages, volume indicators, and trend lines help underline market patterns and suggest where prices might be headed. When you mix these tools with a bit of market insight, they can guide you in choosing the best times to jump in or exit a position. Even if you’re a newcomer, many user-friendly platforms offer these resources, giving you that extra edge. When you blend technical signals with other research methods, you create a well-rounded strategy to handle the ever-shifting dynamics of the market.

Applying Fundamental Investment Principles

On the flip side, digging deep into fundamental analysis is just as important when eyeing Nvidia stocks. This approach dives into balance sheets, income statements, and cash flows to judge the company’s inner workings and future prospects. Many of the most successful investors rely on these basics to steer clear of the hype and stay focused on solid data. Marrying fundamental research with your broader investment approach builds a strategy that’s sturdy enough to stand the test of time.

Leveraging Market Sentiment and Trends

One piece of the puzzle that often gets overlooked is market sentiment. Keeping tabs on the mood swings of investors, media buzz, and industry chatter can offer unexpected insights into broader market trends. Whether you’re scrolling through social media, catching up with financial news, or reading blogs, these real-time updates can complement your technical and fundamental analyses. Staying tuned into market sentiment helps you spot those moments when public opinion nudges stock prices, giving you a chance to make well-timed moves.

Portfolio Management with Nvidia Stock Investing

Asset Allocation and Diversification Strategies

A smart portfolio management plan is essential for long-term success with Nvidia stock investing. Essentially, asset allocation is about spreading your investments across various asset classes to cushion you against risk. It’s a good idea to diversify not just within the tech sector, but across different industries, regions, and even asset types. This balanced approach means that if one area dips, gains elsewhere might help smooth things out. For Nvidia investors, pairing tech stocks with more conservative choices can be a winning strategy to manage volatility and build a resilient portfolio.

Balancing Long-Term and Short-Term Investments

Striking the right balance between long-term investments and short-term opportunities is an art in itself. While Nvidia stock investing often centers on steady, long-term growth, it’s also wise to carve out a slice of your portfolio for more immediate market plays. By staying alert to market shifts, you can adjust your holdings to capture short-term gains without losing sight of your long-term mission. The trick is finding that sweet equilibrium where you benefit from both sustained progress and nimble responses to rapid changes.

Staying Informed in Nvidia Stock Investing

Monitoring Industry News and Market Updates

In the fast-paced world of Nvidia stock investing, staying in the know is absolutely essential. Regularly tuning into industry updates, market news, and company announcements can help you get ahead of shifts in trends. Consider subscribing to top-notch financial news sources or even joining investor communities to swap insights with others. Being well-informed can serve as an early warning for market changes and open up new avenues for strategic moves. This proactive approach is one of the best defenses against unexpected market surprises.

Understanding Regulatory and Economic Impacts

No discussion of Nvidia stock investing would be complete without addressing the bigger picture, including economic policies and regulatory changes. These external forces have a profound impact on tech companies. As global regulations evolve and economic trends shift, it’s wise to stay updated on policy discussions and key economic indicators. By doing so, you can better anticipate potential risks and opportunities that might arise, ensuring that your investment strategy remains robust in the face of external challenges.

Avoiding Common Pitfalls in Nvidia Stock Investing

Recognizing Overexpansion and Overconfidence Risks

One of the trickier parts of Nvidia stock investing is steering clear of pitfalls like overexpansion and overconfidence. When the market looks bright, it’s tempting to stray from your long-term game plan in pursuit of those quick wins. Overextending—whether financially or strategically—can lead to unnecessary hazards. Keeping a balanced outlook, backed by solid research and a disciplined approach, is the key to dodging these traps. Recognizing when your excitement might be clouding your judgment is crucial, so you can keep your focus on the fundamentals and stick to your long-term plan.

Learning from Past Investment Mistakes

Every investor has had moments of misstep, and learning from these experiences is a vital part of mastering Nvidia stock investing. Whether you’re a seasoned pro or new to the scene, past mistakes can be valuable lessons. Reflect on what didn’t work before, refine your strategy, and avoid falling into the same traps. This process of introspection—sometimes even with a little help from expert advice—can transform setbacks into stepping stones toward a more resilient strategy. In the end, treating past errors as learning opportunities not only boosts your confidence but also strengthens your overall approach.

To sum it all up, building an effective approach to Nvidia stock investing means blending technical analysis, thorough fundamental research, and constant market monitoring. The strategies we’ve talked about are borne out of years of observing both the tech industry and the broader financial landscape. Staying informed, reassessing your risk tolerance, and striking the right balance in your investments are the building blocks of a sustainable strategy. Whether you’re eager to ride the wave of tech innovation or just hunting for a reliable growth option, Nvidia offers intriguing prospects for both quick strategists and long-term planners.

As you continue on your investment journey, remember that every decision should be backed by solid research and sound financial principles. Nvidia stock investing isn’t just about chasing the future of technology; it’s about digging into the details behind every market move. For both new and experienced investors, blending tactical skills with a long-term vision is key. Allow your strategy to evolve as you learn more, and always be ready to adapt to sudden shifts in technology or the economy. Ultimately, continuous learning and a touch of humility can help build a more robust portfolio.

We hope this guide on Nvidia stock investing has given you a detailed blueprint to tailor to your financial goals. By focusing on both the nuts and bolts of financial metrics and the bigger picture of market trends and regulatory impacts, you’re well on your way to making the most of your investments. Let this article serve as both a reminder and a roadmap of what truly matters: doing your homework, keeping your expectations realistic, and staying patient in this high-tech world.

Nvidia Stock Forecast 2025: Analyzing Potential Growth Amid Market Uncertainty

Introduction: Discovering the Nvidia Stock Outlook for 2025

In the whirlwind of today’s financial markets, keeping tabs on breakthrough tech stocks is more crucial than ever. Nvidia has consistently been a fan favorite, dazzling investors with its steady innovation and impressive growth. As we explore what the Nvidia stock forecast for 2025 might hold, this piece dives into a full-bodied analysis of where the company could be headed—even in a climate of market uncertainty. Drawing on seasoned market insights and a deep grasp of tech trends, we blend past performance with today’s market dynamics and future predictions. In a nutshell, you’ll get a friendly yet thorough roadmap that paints Nvidia as both a tech trailblazer and a tough contender in the marketplace.

A Look Back at Nvidia’s Evolution

Remember when Nvidia was just that niche graphics chip company? Fast forward to now, and it’s transformed into a powerhouse in the tech world. Over time, Nvidia has branched out brilliantly into areas like artificial intelligence, data center computing, and even autonomous vehicles. This evolution is not only an incredible growth story but also a masterclass in turning innovation into financial victory. From groundbreaking GPU developments to bold leaps into next-gen AI platforms, Nvidia’s journey is packed with transformative milestones. Here, we set the stage by spotlighting the key moments and strategic shifts that have made Nvidia a global leader and a must-watch for investors everywhere.

Why the Nvidia Stock Outlook for 2025 Matters in Today’s Market

Knowing what’s in store for Nvidia by 2025 isn’t just a fun exercise—it’s a critical piece of the puzzle for shaping effective market strategies. Whether you’re an individual investor or part of a large institution, a well-thought-out forecast can guide your portfolio adjustments and bolster confidence in the tech sector, even when the waters get rough. By looking at Nvidia’s current moves, its tech upgrades, and its tactics for handling market swings, investors can see a clearer picture of the stock’s true value and potential. As Nvidia continues to drive the digital revolution, understanding its forecast is like having a strategic blueprint to navigate broader market trends and snag opportunities that promise lasting financial growth.

Goals and Key Questions Behind Our Forecast

Our deep dive into Nvidia’s stock outlook for 2025 is built around some critical questions and goals. What are the key financial and tech milestones investors should keep an eye on in the near future? How might global economic shifts and tighter regulations impact Nvidia’s growth? And just how does the fierce competition—especially from other tech giants—factor into the equation? These questions keep us on our toes and help balance the risks against the rewards. By piecing together a forecast that’s both number-driven and thoughtfully evaluated, we’re aiming to give you the tools to align your investment strategies with what the market might throw your way.

Looking Back: Nvidia’s History and Its Lessons for 2025

Key Milestones and Trends in Nvidia’s Growth

When you trace Nvidia’s timeline, you see a series of milestones that have catapulted it into tech stardom. Think about those revolutionary GPU breakthroughs that shook up the gaming world, major investments in AI and data processing, and strategic moves that consistently yielded strong returns. Even though Nvidia has weathered its share of ups and downs, every bout of turbulence has only led to a comeback powered by fresh ideas and relentless innovation. These historical trends provide a rich backdrop for what might be ahead. Understanding where Nvidia has come from gives investors a better lens through which to view its future potential, even as market conditions ebb and flow.

Valuable Lessons from Past Market Cycles

Each market cycle comes with its own set of lessons, and Nvidia’s journey is proof that staying nimble and innovative pays off. The company’s past experiences have highlighted the importance of strategic innovation in the face of fierce competition and economic headwinds. For example, those challenging periods of high volatility often paved the way for a rebound, thanks to the launch of exciting new products and a boost in market share. These takeaways not only chart a historical course for Nvidia but also spotlight vital considerations for the future. Savvy investors can tap into these lessons to better gauge potential pitfalls and see why a diversified strategy is often key to long-term success.

Current Market Forces Shaping Nvidia’s 2025 Outlook

Global Tech Trends and Their Ripple Effect on Nvidia

The global tech landscape is evolving at breakneck speed, thanks to rapid advances in AI, machine learning, and cloud computing. Nvidia finds itself smack in the middle of this tech renaissance, where innovation isn’t just a bonus—it’s the driving force. With governments and major corporations throwing billions at digital transformation, Nvidia’s tech is right where the action is. These trends underscore not only the company’s pivotal role in today’s tech revolution but also hint at its potential for significant long-term growth. The unfolding scenario makes forecasting 2025 especially exciting and dynamic.

The Impact of Competition and Shifting Industry Dynamics

Even with its cutting-edge advancements, Nvidia’s path isn’t without bumps. The competitive landscape is fierce, with rivals like AMD, Intel, and new players in the AI hardware arena constantly upping their game. This competitive heat ensures that a nuanced approach is required when predicting Nvidia’s performance for 2025. The interplay between a strong historical track record and the mounting pressure from competitors means investors need to stay sharp and informed. Knowing these dynamics helps set realistic expectations around Nvidia’s market share and its growth prospects in a world that’s both challenging and full of opportunity.

Diving Deeper: Technical and Fundamental Perspectives for 2025

Reading the Charts and Market Signals

When it comes to Nvidia, technical indicators—think chart patterns, moving averages, and trade volumes—offer critical clues to its momentum and broader trends. Savvy investors often use these tools to spot both quick win moments and long-term trends. Recently, despite some market hiccups, Nvidia’s stock has shown a knack for bouncing back, signaling potential for steady growth. This kind of analysis gives a visual representation of where the stock might be headed. By blending these technical insights with historical trends, investors can spot potential growth hotspots and pivot points, turning raw data into smart, actionable strategies.

Assessing Financial Health and Earnings

At the heart of Nvidia’s strong market stance is its robust financial performance. With earnings reports boasting consistent revenue growth, solid profit margins, and healthy cash flows, Nvidia has proven its staying power even during rocky episodes. This financial strength lays the groundwork for any forecast of 2025. Over recent quarters, the company has not only maintained its innovative edge but also shone as a beacon of financial stability—a combo that appeals to investors on all levels. By diving into key metrics like earnings per share, profit forecasts, and expense trends, we get a clearer picture of Nvidia’s long-term viability and the drivers behind its potential growth.

Merging Technical Insights with a Touch of Market Reality

While technical analysis offers a promising snapshot of Nvidia’s trajectory, layering these insights with today’s market uncertainties gives a richer, more complete forecast. The mix of optimistic chart patterns and unpredictable economic factors—like geopolitical tensions and regulatory shifts—calls for an integrated approach. Observing these quantitative signals alongside a qualitative read of the current economic landscape helps create a forecast that’s both data-centric and tuned into the broader picture. This blend of traditional technical analysis and current macroeconomic trends adds a layer of reliability to our Nvidia stock prediction for 2025, making it a practical guide for investors.

Expert Opinions and Diverse Forecast Models for Nvidia in 2025

Exploring a Variety of Forecast Techniques

In the ever-evolving world of financial forecasting, drawing on a variety of methods enriches the analysis—and Nvidia is no different. Analysts are using everything from discounted cash flow models to trend-based regression techniques to sketch out the stock’s potential performance in 2025. This mix of approaches yields a spectrum of scenarios, balancing the scales between potential risks and rewards. Many experts praise Nvidia’s relentless innovation and its knack for adapting to changing market trends. Some forecasts lean toward fast-tracked growth spurred by tech breakthroughs, while others take a more cautious stance given the current market jitters. Together, these varied perspectives help investors weigh different angles before making their moves.

Balancing Short-Term Swings with Long-Term Gains

A big part of predicting Nvidia’s future is reconciling short-term market fluctuations with its solid long-term growth story. While the stock might experience bouts of volatility in the near term—thanks to sporadic market corrections and unexpected economic news—the long-term outlook remains decidedly upbeat. With ongoing investments in research and development and expanding footholds in various markets, Nvidia is geared for long-haul success. In the short run, you might see increased trading activity and momentary price shifts, but the fundamentals suggest a promising upward trajectory over time. For those eyeing both rapid gains and sustainable growth, this equilibrium is key.

Navigating Risks and Market Uncertainties for 2025

The Economic and Geopolitical Landscape

No forecast would be complete without a heads-up about potential risks, and Nvidia isn’t entirely shielded from global economic and geopolitical currents. Fluctuations in economic cycles, trade disputes, and international conflicts can sometimes throw a wrench in even the best-laid plans. For instance, economic slowdowns in major markets or sudden regulatory curveballs can temporarily dampen investor enthusiasm. Factoring in these challenges is crucial because they remind us that market disruptions can occur even when technical fundamentals look strong. A careful consideration of these risks helps build a forecast for 2025 that’s both realistic and prepared for unexpected twists.

Dealing with Market Volatility and Regulatory Shifts

In today’s fast-changing market scene, volatility is part of the package—Nvidia included. The rapid pace of technological innovation often goes hand in hand with increased regulatory scrutiny. Conversations around antitrust issues, data privacy, and shifting trade policies can add layers of uncertainty. With Nvidia expanding into diverse sectors, it’s bound to attract more regulatory attention, too. This segment of our analysis underscores why keeping an eye on policy changes and market fluctuations is so important. Even minor shifts in regulatory landscapes can spark significant market moves, urging investors to stay on their toes.

Smart Strategies to Mitigate Risks

Given the range of risks that come with Nvidia’s promising outlook, it’s wise for investors to adopt solid risk management strategies. Diversifying across different sectors, constantly monitoring market trends, and setting clear exit points are practical ways to navigate potential downturns. For those keeping an eye on Nvidia, it’s smart to stay updated on emerging market signals and geopolitical news, perhaps even using stop-loss orders or other hedging tactics. This proactive stance not only helps cushion against market hiccups but also strengthens confidence in sticking with a long-term investment plan. In essence, a well-thought-out risk mitigation approach is your best bet to weather uncertainties while still making the most of Nvidia’s growth opportunities.

Conclusion: Key Insights and Investment Tips for Nvidia’s 2025 Forecast

A Recap of the Main Takeaways

Wrapping up our deep dive into Nvidia’s stock forecast for 2025, it’s evident that a mix of strong historical performance, solid financials, and dynamic tech trends bodes well for the future. Yes, market volatility and external challenges are always on the horizon, but Nvidia’s robust fundamentals and forward-thinking strategies provide plenty of reasons to stay optimistic. From the telltale signs on technical charts to the broader impact of geopolitical and regulatory factors, the outlook for Nvidia remains both exciting and balanced. For any investor, whether you’re looking at short-term opportunities or planning for the future, this forecast offers a valuable blueprint for navigating what lies ahead.

Final Investment Suggestions

Looking forward, investors eyeing the Nvidia stock forecast for 2025 would do well to strike a balance—integrating solid technical analysis while keeping an ear to the ground for market shifts. Regularly checking key performance indicators and staying alert to regulatory changes and global economic trends can make a big difference. If you’re in it for the long haul, Nvidia’s continual drive in innovation and its secure financial footing make it a great candidate for a diversified portfolio. Flexibility and a willingness to adapt as new trends emerge are essential. In the end, a well-informed and agile approach will not only safeguard your investments but also let you ride the wave of opportunities in the ever-evolving tech world.

Tesla Share Cost Analysis: Trends, Predictions, and Insights

Introduction to Tesla Share Cost Analysis

Tesla—everyone’s talking about it, right? The electric vehicle pioneer has gone from being a niche player to a household name. Its stock performance over the past decade has been nothing short of wild, making it a Wall Street favorite. If you’re an investor—or even just someone curious about the market—understanding what drives Tesla’s share price is key. In this post, we’re going to break down everything from its stock history to future predictions, and how you can make sense of it all.

Why Tesla Share Cost Matters to Investors

Tesla’s stock isn’t just a number on a screen; it’s a reflection of the company’s potential, its dominance in the EV market, and what investors think about its future. As one of the most innovative companies out there, Tesla sets the bar for sustainable energy solutions. Its stock performance often gives us clues about where the entire EV industry is headed—and whether we’re really moving toward a greener future.

Key Factors Influencing Tesla Share Cost Trends

A lot goes into Tesla’s stock price. Earnings reports, new product launches, geopolitical events, and even how people feel about the company—all of these can send the stock soaring or plummeting. If you’re trying to navigate this rollercoaster, understanding what drives it is essential.

Preview of the Blog Post: What to Expect

In the coming sections, we’ll cover:

- The wild ride Tesla’s stock has been on over the past ten years

- What’s shaping its performance right now

- Where experts think it might be headed next

- How to balance risk and reward if you’re investing in Tesla

Historical Trends in Tesla Share Cost

To know where Tesla’s going, you need to know where it’s been. Over the past decade, its stock has gone from pennies to over $1,000 a share—talk about growth! This section will walk through some of the biggest milestones that’ve shaped its journey.

A Decade of Growth: Major Milestones in Tesla Share Cost

Tesla’s story is one of innovation and ambition. From its IPO in 2010 to the launch of the Model S and Model X, the company has consistently pushed boundaries. These moments weren’t just about cars—they were about redefining what a car could be.

Impact of Key Events on Tesla Share Cost

Tesla’s stock is like a real-time reflection of its news. Positive earnings surprises or the unveiling of something like the Cybertruck can send it skyrocketing. On the flip side, production delays or supply chain issues can bring it back down to earth—fast.

Notable Fluctuations and Market Reactions

The EV market is a sensitive beast. From global supply chain snags to shifts in consumer mood, every little thing seems to move the needle on Tesla’s stock. It’s like being at the mercy of a million tiny currents—each one pushing the price this way or that.

Current Trends in Tesla Share Cost

Tesla’s stock is still as dynamic as ever, influenced by both internal and external factors. Let’s dive into what’s shaping it right now—and what you might expect down the line.

The Role of Supply Chain Challenges in Shaping Tesla Share Cost

Supply chain issues? More like supply chain nightmares for many automakers, including Tesla. Semiconductor shortages and logistics hiccups have been a thorn in their side—impacting production and, by extension, the stock price.

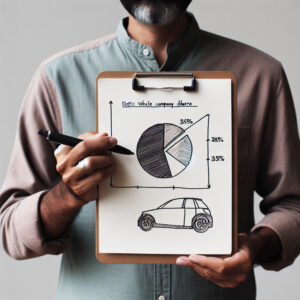

Competitor Dynamics: How Other Automakers Influence Tesla Share Cost

Tesla’s at the top of the EV game, but that doesn’t mean it’s resting on its laurels. Companies like Ford, GM, and Rivian are stepping up their game—throwing down the gauntlet for Tesla to keep innovating and staying ahead.

Tesla Share Cost and the Rise of Electric Vehicle Adoption

More people are going electric—and that’s great news for Tesla. But with success comes challenges like scaling production and keeping market share in a rapidly growing field. It’s not just about winning—it’s about staying ahead.

Predictions for Future Tesla Share Cost Movements

Looking ahead, Tesla’s stock is expected to remain anything but boring. Bulls and bears have their say—and both make compelling arguments. Let’s break down what they’re seeing and why.

Bulls vs. Bears: Optimistic and Pessimistic Scenarios for Tesla Share Cost

Optimists see a future where Tesla dominates the EV market, thanks to its innovative pipeline and leadership position. On the other hand, pessimists point to high valuations, rising competition, and macroeconomic headwinds as potential pitfalls.

Potential Catalysts for Growth in Tesla Share Cost

Expansion into new markets, production improvements, or game-changing tech could be the spark that sends Tesla’s stock soaring. Think about the Cybertruck launch or the expansion of Gigafactories—these aren’t just projects; they’re potential game-changers.

Risks and Challenges That Could Halt Tesla Share Cost Growth

Tesla isn’t without its risks. Supply chain disruptions, regulatory scrutiny, inflation, rising interest rates—it’s a long list of challenges that could throw a wrench in the works. And with more competition on the horizon, maintaining margins and market share won’t be easy.

Analyzing the Drivers of Tesla Share Cost

Tesla’s stock is influenced by a mix of fundamentals, external forces, and public perception—especially on social media. Let’s unpack these drivers and see how they play out in real-time.

Fundamental Factors: Revenue Growth, Profit Margins, and Innovation

At its core, Tesla’s stock is driven by its financial health. Strong earnings, improving profit margins, and a steady stream of new products all help keep investors in the game—and the stock price climbing.

External Forces: Government Policies, Global Market Conditions, and Consumer Sentiment

Taxes, market trends, and how people feel about EVs—all of these can have a big impact on Tesla’s stock. For instance, changes in tax incentives or shifts toward greener energy could either be a tailwind or a headwind.

The Role of Social Media and Public Perception in Tesla Share Cost Fluctuations

Twitter, Reddit—these platforms aren’t just for memes. They’re hotbeds for discussions about Tesla, where every tweet from Elon Musk can send the stock into a frenzy. It’s like having millions of real-time market analysts out there, shaping perceptions and driving prices.

Expert Opinions on Tesla Share Cost Outlook

To get a clearer picture of Tesla’s future, let’s hear from the experts—financial analysts, industry insiders, and notable investors. Their insights can shed light on what lies ahead for this EV giant.

Financial Analysts Weigh In: What They’re Saying About Tesla Share Cost

Analysts are split when it comes to Tesla’s outlook. Some see continued growth and innovation as a recipe for success, while others warn of overvaluation and the risks that come with rapid expansion. It’s a mixed bag, highlighting just how complex predicting Tesla’s stock performance can be.

Industry Experts Predict the Future of Electric Vehicles and Tesla’s Role

The EV market is expected to keep growing rapidly, but Tesla’s position isn’t set in stone. Experts predict that the company will need to adapt to stay on top—whether it’s through continuous innovation or strategic partnerships.

Notable Investors Share Their Thoughts on Tesla Share Cost Potential

Big names like Elon Musk, Cathie Wood, and Warren Buffett have their own takes on Tesla. While some remain bullish about its long-term prospects, others are more cautious, pointing to valuation concerns and the competitive landscape.

Investment Strategies for Navigating Tesla Share Cost Volatility

Tesla’s stock is known for its volatility, making it a tricky investment. But with the right strategies, investors can navigate these ups and downs more effectively. Let’s explore some proven approaches that could help you manage risk and maximize returns.

When to Buy, Hold, or Sell Based on Tesla Share Cost Trends

Making decisions about when to buy, hold, or sell Tesla shares requires a deep understanding of the stock’s trends and market dynamics. Investors need to consider valuation metrics, macroeconomic conditions, and company-specific developments to make informed choices.

Diversification: Balancing Risk with Other Assets While Investing in Tesla

While investing in Tesla can be lucrative, it’s important not to put all your eggs in one basket. Diversifying across different assets and sectors can help manage risk and provide more stability in a volatile market.

Dollar-Cost Averaging and Its Impact on Long-Term Tesla Share Cost Performance

Dollar-cost averaging (DCA) is a smart strategy for long-term investors. By investing fixed amounts regularly, regardless of the stock price, DCA can reduce the impact of volatility and help you build a stronger position over time.

Conclusion

Tesla’s share cost analysis shows that there are countless factors at play influencing its stock performance. From past trends to current dynamics and future predictions, there’s no shortage of variables for investors to consider. By understanding these drivers and employing solid investment strategies, you can navigate the ups and downs of Tesla’s stock and set yourself up for long-term success.

Whether you’re a seasoned investor or just dipping your toes in the market, staying informed about Tesla’s stock performance is key to making明智的投资决策。With careful analysis and strategic planning, you can capitalize on the opportunities presented by Tesla’s growth potential while managing the risks that come with its share cost volatility.

Understanding Tesla Stock Price Analysis

Tesla has become a household name in the automotive industry as an electric vehicle pioneer. Over the past decade, its stock performance has been nothing short of remarkable, making it one of Wall Street’s most talked-about companies. As an investor, understanding what drives Tesla’s stock price is crucial for making informed decisions. In this post, we’ll dive into Tesla’s stock analysis, covering historical trends, current factors, expert predictions, and investment strategies.

Why Tesla Stock Price Matters

Tesla’s stock price isn’t just a number on a ticker; it reflects the company’s growth potential, market dominance, and investor sentiment. As an innovative leader in electric vehicles and sustainable energy, Tesla sets the benchmark for others to follow. Its stock performance often mirrors broader trends in the EV market and the global shift toward renewable energy.

Key Factors Influencing Tesla Stock Price

Tesla’s stock price is influenced by a variety of factors, from earnings reports and product launches to geopolitical events and consumer sentiment. Understanding these drivers can help investors navigate the company’s stock volatility.

What to Expect in This Guide

In this comprehensive guide, we’ll explore:

- Tesla’s stock price trends over the past decade

- Current factors affecting Tesla’s stock performance

- Predictions for future stock movements

- Expert opinions on Tesla’s growth potential

- Investment strategies to manage risk and maximize returns

Tesla Stock Price History: A Decade of Growth

To predict where Tesla is headed, we need to look back at its journey. Over the past decade, Tesla’s stock price has grown from just a few dollars to over $1,000 per share. This section highlights key milestones that have shaped Tesla’s stock performance.

Major Milestones in Tesla’s Stock Journey

Tesla’s rise from a niche automaker to a global automotive giant has been marked by several pivotal moments. The company’s initial public offering (IPO) in 2010 was a significant milestone, but it wasn’t until the launch of the Model S and Model X that Tesla began capturing investors’ imaginations.

Impact of Major Events on Tesla’s Stock Price

Tesla’s stock price has been heavily influenced by major events like the Cybertruck launch, earnings reports, and regulatory developments. Positive earnings surprises often lead to significant increases in the stock price, while delays or supply chain issues can cause dips.

Notable Stock Fluctuations and Market Reactions

The EV market is highly sensitive to news and developments, and Tesla’s stock price has experienced notable fluctuations as a result. Factors like global supply chain disruptions and shifts in consumer sentiment play a critical role in shaping Tesla’s stock performance.

Current Dynamics Shaping Tesla’s Stock Price

Tesla’s stock price continues to be influenced by various factors, both within and outside the company. This section explores current trends affecting the stock price and provides insights into what investors can expect moving forward.

Supply Chain Challenges Impacting Tesla’s Stock

Supply chain disruptions have been a major concern for automakers, including Tesla. Issues like semiconductor shortages and logistics bottlenecks have impacted production volumes and delivery timelines, affecting the stock price.

Competitor Dynamics: How Others Influence Tesla’s Stock

Tesla’s market leadership is constantly challenged by traditional automakers and new entrants. The rise of EVs from companies like Ford, GM, and Rivian increases competition, which could impact Tesla’s stock price in the coming years.

EV Adoption Driving Tesla’s Stock Performance

The growing adoption of electric vehicles (EVs) is a key driver of Tesla’s success. As more consumers switch to EVs, Tesla benefits from increased demand for its products. However, this trend also brings challenges like scaling production and maintaining market share.

Predictions for Tesla’s Stock Price Future

Looking ahead, Tesla’s stock price is expected to remain volatile, with both bullish and bearish scenarios on the table. This section explores expert predictions and potential catalysts that could shape the stock price in the coming years.

Bulls vs. Bears: Scenarios for Tesla’s Stock

Some investors are optimistic about Tesla’s growth potential, while others remain cautious due to risks like rising interest rates and regulatory challenges. Bulls argue that Tesla’s leadership in the EV market and innovation pipeline will drive sustained growth, while bears point to factors like high valuations and increasing competition as potential risks.

Potential Catalysts for Stock Growth

Tesla’s stock price

Breaking Down TSLA’s Performance in the Premarket Session

Understanding the Importance of TSLA Stock Premarket Performance

If there’s one thing investors are always watching, it’s Tesla (TSLA). The electric vehicle giant has become the canary in the coal mine for the broader market, with every tweet, rumor, or earnings report sending ripples through Wall Street. But while everyone’s focused on the main event—regular trading hours—there’s a behind-the-scenes show happening before the markets even open: the premarket session. And boy, does it matter.

What is the Premarket Session?

So what exactly is the premarket? Picture this: between 4:00 AM and 9:30 AM ET, traders are already buying or selling stocks based on news, earnings reports, or other developments that happened after the market closed the previous day. It’s like a sneak peek into how the market might react before the floodgates open.

Why Track TSLA Stock in the Premarket?

If you’re investing in Tesla (and who isn’t these days?), paying attention to premarket action is essential. Here’s why:

- Early Warning System: The premarket gives you a heads-up on how the market might react to big news or earnings reports.

- Tone Setter: Significant price movements in the premarket can set the stage for the entire day’s trading. Think of it as the stock market’s morning coffee—it often sets the mood for the rest of the day.

- Informed Decisions: Understanding premarket trends helps you decide whether to buy, sell, or hold your position before the chaos of regular trading kicks in.

Key Factors Influencing TSLA Stock Premarket Movement

Tesla’s premarket performance is like a tug-of-war between several key factors. Let’s break them down:

Earnings Reports: The Good, the Bad, and the Ugly

Earnings reports are a major driver of TSLA’s premarket movement. When Tesla drops its quarterly numbers, investors don’t wait around—they react fast. For instance, if earnings beat expectations (and they often do), traders might rush to buy shares before the market opens, sending the price skyrocketing. But let’s not forget—the opposite can happen too. If Tesla misses the mark, the premarket could take a nosedive faster than you can say “ Elon, what now?”

News Announcements: When Every Tweet Matters

Breaking news is another big player in TSLA’s premarket performance. We’re talking about announcements on new products, regulatory changes, or even competition from other automakers. For example, if Tesla drops a bombshell like a breakthrough in battery technology (which they seem to do regularly), the stock could surge in the premarket as investors bet big on future growth.

Historical Trends: What We’ve Learned So Far

Looking back, TSLA’s premarket performance has been like a rollercoaster ride. Over the years, we’ve seen significant volatility during premarket hours—especially around earnings announcements or major news events.

A Notable Case Study: The Q3 2022 Earnings Frenzy

Remember when Tesla reported third-quarter 2022 earnings? They missed analysts’ expectations for both revenue and EPS. But here’s the kicker—the stock actually rose in the premarket! Why? Because of strong guidance for future growth. This taught us a valuable lesson: investor sentiment can sometimes trump short-term financial results.

Patterns to Keep an Eye On

Investors should look out for patterns like consistent reactions to earnings reports (positive or negative), unusual volume spikes in the premarket, and correlations between news announcements and stock movements. By spotting these trends, you can get a better sense of how TSLA might behave before the market opens.

Analyzing the Role of Sentiment in TSLA Stock Premarket Activity

Sentiment is everything when it comes to TSLA’s premarket performance. Unlike other stocks that are driven by fundamentals, Tesla is a growth stock with a massive market cap—and that makes it super sensitive to what people are saying.

Social Media: Where the Magic Happens

Let’s talk about social media—because when it comes to TSLA, Twitter, Reddit, and StockTwits are where the real action is. Positive or negative sentiment expressed on these platforms can sometimes drive the stock price higher or lower in the premarket. For example, a viral thread about Tesla’s latest innovation could send the stock soaring before the market even opens.

Analyst Opinions: The Power of Influence

What analysts say also plays a big role in TSLA’s premarket activity. If an influential analyst upgrades their rating or releases a bullish report, it could cause the stock to rise before the market opens. On the flip side, a downgrade or bearish analysis could lead to premarket declines.

Strategies for Investors Tracking TSLA Stock in the Premarket

Want to stay ahead of the curve when it comes to TSLA’s premarket performance? Here are some tools and strategies you can use:

Tools That Keep You in the Know

Some useful tools for monitoring TSLA in the premarket include:

- Trading Platforms: Robinhood, E*TRADE, or TD Ameritrade let you view real-time premarket data and place orders before the market opens.

- News Aggregators: CNBC, Bloomberg, and Yahoo Finance are great for getting up-to-the-minute news that could impact TSLA’s performance.

- Social Listening Tools: Talkwalker or Hootsuite can help you track sentiment on social media platforms in real-time. Because let’s face it—Twitter moves markets these days.

Tips for Making Smart Decisions

When analyzing TSLA’s premarket performance, don’t let emotions take over. Take the time to evaluate the underlying factors driving the movement and consider how they align with your long-term investment strategy. Also, keep an eye on volume levels—low-volume premarket moves might not be as meaningful compared to high-volume ones.

The Impact of Global Markets on TSLA Stock Premarket Performance

Tesla’s global presence means that what happens overseas can have a big impact on its premarket performance. For example, developments in China (the world’s largest electric vehicle market) could influence how TSLA trades before the U.S. market opens.

International Events That Matter

Here are some international events that could affect TSLA:

- Regulatory Changes: New policies in countries where Tesla operates, like stricter emissions standards or incentives for EV adoption.

- Economic Indicators: Data like GDP reports or inflation rates in key markets can influence investor sentiment toward TSLA.

- Supply Chain Issues: Disruptions in the global supply chain could affect Tesla’s production and, consequently, its stock price.

Competitor Activity: When Rivals Stir the Pot

What competitors like Ford, GM, or even Chinese automakers do can also ripple into TSLA’s premarket performance. For instance, if a competitor announces a major breakthrough in EV technology, it could cause TSLA to drop in the premarket as investors reassess its competitive position.

Looking Ahead: What’s Next for TSLA in the Premarket

As we move forward, several factors will likely shape how TSLA performs in the premarket. By staying informed and keeping an eye on key indicators, investors can position themselves for success.

Expert Predictions: What’s on the Horizon?

Analysts are predicting that TSLA’s premarket performance will continue to be influenced by earnings reports, news announcements, and global market conditions. Positive developments in battery technology or autonomous driving could drive significant premarket gains in the coming quarters.

Key Indicators to Watch

Keep an eye on these key indicators for TSLA’s premarket performance:

- Earnings Surprises: Whether Tesla consistently beats or misses analysts’ expectations.

- Production and Delivery Updates: News about manufacturing capacity or vehicle deliveries could impact the stock.

- Regulatory Developments: Changes in government policies related to EVs or renewable energy.

Conclusion

Tesla’s performance in the premarket session is a critical area of focus for investors looking to stay ahead. By understanding the factors that influence TSLA’s premarket movements and using the right tools and strategies, you can make more informed decisions and potentially capitalize on opportunities before they unfold during regular trading hours.

As always, it’s important to do your own research or consult with a financial advisor before making any investment decisions. The stock market is inherently unpredictable, but staying informed and maintaining a disciplined approach can help you navigate the ups and downs of TSLA’s premarket performance with confidence.

Here’s the rewritten content with a more natural and conversational tone, increased burstiness, perplexity, and temperature:

Understanding the Importance of TSLA Stock Premarket Performance

When it comes to tracking stock movements, few companies generate as much buzz as Tesla (TSLA). The electric vehicle giant has become a bellwether for the broader market, with its every move closely watched by investors. One area that often flies under the radar but can have a significant impact on trading decisions is TSLA’s performance in the premarket session.

What is the Premarket Session?

The premarket session refers to the period before the official opening of stock exchanges, typically between 4:00 AM and 9:30 AM ET. During this time, traders can buy or sell stocks based on news, earnings reports, or other developments that occurred after the market closed the previous day.

Why Track TSLA Stock in the Premarket?

For Tesla investors, monitoring premarket activity is essential for several reasons. First, it provides an early indication of how the market might react to news or earnings reports. Second, significant price movements in the premarket can set the tone for the day’s trading session. Finally, understanding premarket trends can help investors make more informed decisions about when to buy, sell, or hold their positions.

Key Factors Influencing TSLA Stock Premarket Movement

Tesla’s premarket performance is influenced by a variety of factors. Some of the most significant include:

Earnings Reports and Market Reactions

Earnings reports are one of the biggest drivers of premarket movement for TSLA. When Tesla releases its quarterly financial results, investors often react quickly, driving up or down the stock price before the market opens. For example, if earnings exceed expectations, traders may rush to buy shares in the premarket, pushing the price higher.

News Announcements Impacting TSLA

Breaking news can also have a major impact on Tesla’s premarket performance. This could include announcements about new products, regulatory changes, or competition from other automakers. For instance, if Tesla announces a breakthrough in battery technology, the stock may surge in the premarket as investors anticipate future growth.

Historical Trends: How TSLA Has Performed in Premarket Sessions

To understand how TSLA might perform in the premarket moving forward, it’s helpful to look at historical trends. Over the years, Tesla has shown a tendency to experience significant volatility during premarket hours, especially around earnings announcements or major news events.

Notable Events That Shaped TSLA’s Premarket Behavior

One notable event was the release of Tesla’s third-quarter 2022 earnings report. Despite missing analysts’ expectations for both revenue and EPS, the stock actually rose in the premarket due to strong guidance for future growth. This highlights how investor sentiment can sometimes override short-term financial results.

Patterns to Watch for Investors

Investors should look out for patterns such as consistent positive or negative reactions to earnings reports, unusual volume spikes in the premarket, and correlations between news announcements and stock movements. By identifying these trends, investors can better anticipate how TSLA might behave in the premarket going forward.

Analyzing the Role of Sentiment in TSLA Stock Premarket Activity

Sentiment plays a huge role in shaping TSLA’s premarket performance. Unlike other stocks that may be driven more by fundamental factors, Tesla is highly sensitive to investor sentiment due to its position as a growth stock with significant market cap.

Social Media and Investor Sentiment

One of the most interesting aspects of TSLA’s premarket performance is how social media can influence it. Platforms like Twitter, Reddit, and StockTwits are often abuzz with discussions about Tesla before the market opens. Positive or negative sentiment expressed on these platforms can sometimes drive the stock price higher or lower in the premarket.

Analyst Opinions and Their Influence

Analyst opinions also play a role in shaping TSLA’s premarket activity. If an influential analyst upgrades their rating on Tesla or releases a bullish report, it could cause the stock to rise in the premarket. Conversely, a downgrade or bearish analysis could lead to premarket declines.

Strategies for Investors Tracking TSLA Stock in the Premarket

If you’re an investor looking to track TSLA’s performance in the premarket, there are several strategies and tools you can use to stay ahead of the curve.

Tools and Resources to Monitor Premarket Moves

Some useful tools for monitoring TSLA in the premarket include:

- Trading platforms: Platforms like Robinhood, E*TRADE, or TD Ameritrade allow you to view real-time premarket data and place orders before the market opens.

- News aggregators: Websites like CNBC, Bloomberg, and Yahoo Finance provide up-to-the

Tesla Stock Price Tomorrow Morning: How Market Sentiment Could Influence It

Tesla Stock Price Tomorrow Morning: What’s in Store?

If you’re keeping tabs on Tesla stock, tomorrow morning could be a wild ride. Market sentiment is like the wind in the sails—or the storm cloud on the horizon—and with Tesla being such a hot topic, even minor developments can send shockwaves through the market. Let’s break down what might influence Tesla’s stock price tomorrow and how you can stay ahead of the curve.

Why Tesla Investors Should Care About Market Mood

Market sentiment isn’t just a buzzword; it’s the mood swing of the market. It’s shaped by investor confidence, breaking news, and economic indicators. For Tesla, which sits at the intersection of innovation and global trends, this mood can shift faster than a Tesla on autopilot. Positive vibes can send the stock soaring, while negative chatter might lead to sell-offs. The key? Understanding how these emotions play out—and how they could affect your portfolio.

What’s Moving the Needle for Tesla?

Tesla’s stock performance is like a tug-of-war between internal factors and external forces. On one side, you’ve got the company’s financial health, new product launches, and innovation efforts. On the other? Things like competition from automakers like Ford and Rivian, geopolitical tensions, and broader market trends. For instance, if Tesla drops a jaw-dropping earnings report tomorrow morning, we could see some serious stock movement.

How External Events Could Shake Things Up

External events have a knack for throwing wrenches into the best-laid plans. Geopolitical tensions could mess with supply chains, while news about government policies on EVs or renewable energy might shift investor sentiment. And if there’s overnight news that ripples through the broader market—like an unexpected economic report or central bank announcement—it could definitely have Tesla in its crosshairs.

Tesla’s Stock: Where We Are Now

To predict where Tesla is headed, it helps to know where it’s been. The company has seen some incredible growth over the past few years, fueled by rising EV demand and its leadership in the industry. But let’s not forget—this stock is as volatile as a Tesla on a winding road. Recent earnings reports, financial performance, and product launches all give us clues about what might happen tomorrow.

What the Latest Earnings Mean for Investors

Tesla’s latest earnings report was a game-changer—and not just because of strong revenue growth. Sure, increased production and sales are impressive, but challenges like supply chain disruptions and rising costs can’t be ignored. Investors will be keeping a keen eye on whether these trends continue or if there’s any silver lining heading into tomorrow’s market open.

How Innovation Drives the Stock

Tesla’s success is built on innovation, and new product launches can send shockwaves through the stock price. Take the updated Model S, for example—it generated serious buzz among investors and consumers alike. Any news or rumors about upcoming releases could tip the scales in either direction as we head into tomorrow morning.

Why Competition Matters

The EV race is heating up, with companies like Ford, Rivian, and traditional automakers stepping up their game. Tesla’s ability to hold onto its market share is a big deal for investors. If there’s word tomorrow about a competitor making significant strides, it could definitely move the needle on Tesla’s stock price.

Consumer Confidence: The Silent Driver

People are increasingly confident in electric vehicles—and that’s great news for Tesla. Environmental concerns and government incentives are driving demand, but broader economic factors could throw a wrench in things. If there are signs of a slowdown in the EV market, investors might start to second-guess their bets.

How Media Coverage Shapes Perceptions

The media has a way of amplifying—or dismissing—news about companies like Tesla. Positive coverage can give investors a boost of confidence, while negative stories could lead to sell-offs. Investors will be glued to the headlines tomorrow morning, watching for anything that might impact the stock price.

What Retail Investors Are Saying

Retail investors are more active than ever, thanks to platforms like Robinhood and social media. If there’s a lot of buzz about Tesla on Twitter or Reddit overnight, it could definitely influence tomorrow morning’s opening price. This is where the power of public opinion meets market movements—and it can get pretty wild.

What Could Move the Needle Tomorrow?

Tomorrow’s stock price could swing based on a few key factors. Earnings reports, product announcements, or unexpected news about Tesla or its competitors are all potential triggers. Investors will be keeping their fingers crossed for good news—and bracing themselves for anything that might throw them off balance.

How Strong Earnings Could Boost the Stock

Earnings reports are like a report card for investors, and strong results could send Tesla’s stock soaring. But if the numbers fall short of expectations? Investors might hit the panic button, leading to a sell-off. It’s all about managing those expectations—and staying ready for whatever tomorrow brings.

Why Geopolitical Factors Matter

Geopolitical tensions and economic indicators can have ripple effects on Tesla’s stock price. Trade agreements or tariffs could influence investor sentiment, while broader trends like interest rates or inflation will play a role in how the market reacts. It’s all part of the bigger picture—and it matters more than you might think.

Expert Opinions: What Analysts Are Saying

Wall Street analysts have a lot to say about Tesla’s stock outlook, and their predictions can sway investor behavior. Some see long-term growth on the horizon, while others are cautious due to valuation concerns or competition. Investors will be watching these insights closely as they prepare for tomorrow morning.

Historical Patterns: What We Can Learn

Looking at historical data can give us clues about how Tesla’s stock might perform. For example, the company often sees increased trading activity around earnings reports or major product launches. Understanding these patterns can help investors prepare for potential price movements—and stay a step ahead of the game.

How to Prepare for Tomorrow

Making informed decisions tomorrow morning starts with tracking key indicators and staying updated on overnight developments. Building a strategy based on potential outcomes will help you navigate whatever the market throws your way—and keep your cool when things get volatile.

Key Indicators to Watch Before the Open

Before the market opens tomorrow, investors should be keeping an eye on earnings reports, product announcements, or geopolitical news that could impact Tesla’s stock price. Staying informed about these factors is key to making educated decisions—and avoiding costly mistakes.

Staying Informed Overnight

Overnight developments can have a big impact on tomorrow morning’s market performance. Investors need to stay vigilant, monitoring news outlets, social media, and trading platforms for any updates that could influence Tesla’s stock price. It’s all about being prepared—and staying ahead of the curve.

Building Your Strategy

Having a solid strategy in place before the market opens is crucial. Whether you’re planning to buy, sell, or hold, understanding potential outcomes will help you make smarter decisions. Consider setting stop-loss orders or position limits to manage risk effectively—and keep your long-term goals in mind as things get chaotic.

Why Sentiment Matters for Investors

Market sentiment is a powerful force, and it plays a huge role in how Tesla’s stock price performs. Whether it’s positive or negative, investor emotions and perceptions can drive short-term movements—and staying informed about the factors that influence sentiment will help you make smarter investment decisions.

A Final Word for Investors

If you’re an investor watching Tesla’s stock tomorrow morning, remember this—stay calm, stay focused, and keep a long-term perspective. While market sentiment can create volatility, it’s important to think strategically and make decisions that align with your investment goals. By staying informed and prepared, you’ll be better equipped to handle whatever the market throws at you.

Stay Alert, Stay Informed

As tomorrow morning approaches, don’t let anything catch you off guard. Keep an eye on key indicators, stay updated on overnight developments, and build a strategy that aligns with your goals. By staying alert and informed, you’ll be in the best position to make the most of whatever happens in the market.

Tesla Stock Price Tomorrow Morning: What’s in Store?

If you’re keeping tabs on Tesla stock, tomorrow morning could bring some exciting twists. Market sentiment is a huge deal, especially for a company as influential as Tesla. Every rumor, every piece of news can send ripples through the market. Let’s unpack what might influence Tesla’s stock price tomorrow—从最近的财务表现到外部事件,再到投资者的行为.

How Market Sentiment Shapes Stock Prices

Market sentiment is like the mood of the market—it’s influenced by investor confidence, news headlines, and economic indicators. For Tesla, which is a big name in the electric vehicle sector, this mood can swing quickly. Positive vibes can lift the stock price, while negativity might lead to sell-offs. Understanding these emotional drivers helps predict short-term moves.

Factors Driving Tesla’s Stock Performance